The allure of traditional luxury goods like diamonds is fading, and a new contender has emerged, challenging long-held perceptions of value and investment.

Once the epitome of luxury and a symbol of enduring love, diamonds are facing an existential crisis as lab-grown alternatives gain popularity. Meanwhile, Bitcoin, a digital currency once viewed with skepticism, is gaining momentum as a viable investment option. This preference shift marks a significant turning point in luxury goods and investment markets.

Diamond Prices Are Collapsing

For decades, diamonds were considered one of the world’s most powerful and successful industrial cartels, dominated by DeBeers Consolidated Mines in South Africa. This company controlled over 90% of the global diamond market for much of the 20th century.

However, this monopoly has begun to crumble in the 21st century. The rise of lab-grown diamonds poses a significant threat to traditional diamond producers.

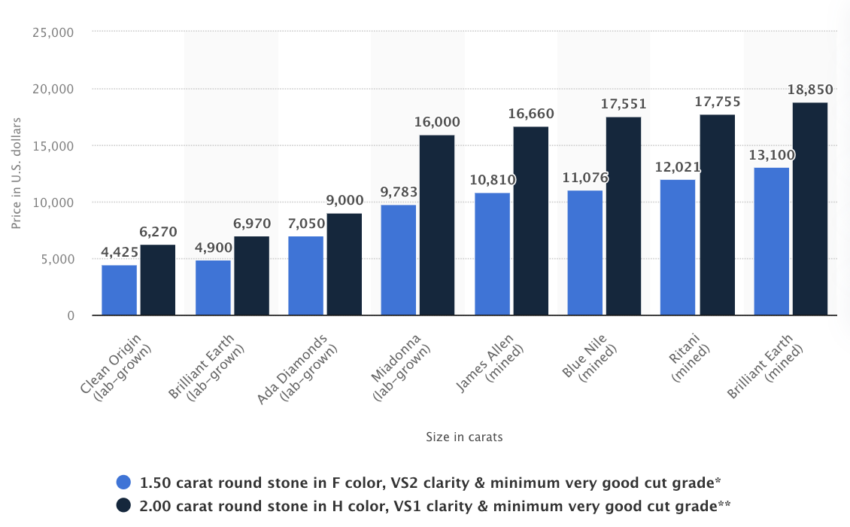

The growing interest in lab-grown diamonds has upended the diamond industry. They offer the same aesthetic appeal and physical properties as natural diamonds at a fraction of the cost. Consumers are increasingly drawn to these alternatives for their affordability, and environmental and ethical advantages.

This shift is evident in retail spaces like Macy’s, where lab-grown diamonds are gaining prominence over their natural counterparts.

“For most people, a diamond is a diamond, and what you want is the wonderful sparkle and the beauty and the meaning that you can put into a diamond,” Mary Carmen Gasco-Buisson, Chief Marketing Officer at Pandora.

Lab-grown diamonds, once referred to as “synthetic,” have been rebranded by the Gemological Institute of America, reflecting their authenticity as luxury goods. The Federal Trade Commission’s recognition of these products as true diamonds has further legitimized them, leading to a surge in global sales.

“Laboratory-grown diamonds have essentially the same chemical, optical and physical properties and crystal structure as natural diamonds. Like natural diamonds, they are made of tightly-bonded carbon atoms. They respond to light in the same way and are just as hard as natural diamonds. The main differences between laboratory-grown and natural diamonds lie in their origin,” the Gemological Institute of America.

For instance, in 2022 alone, lab-grown diamond sales reached $12 billion, a 38% increase from the previous year.

The diamond market’s decline, exacerbated by global inflation and changing consumer preferences, has broader implications for investment strategies. While traditional luxury goods lose their luster, investors turn to alternative assets like Bitcoin.

Bitcoin (BTC) Will Hit $1 Million

Bitcoin’s rise as an investment option is as dramatic as the fall of diamonds. Once a niche digital currency, Bitcoin has captured the attention of institutional and individual investors alike. Its limited supply and decentralized nature make it an attractive hedge against inflation and market volatility