The co-founder of the crypto analytics firm Glassnode thinks the current macro environment offers a “perfect setup” for riskier assets like Bitcoin () to thrive.

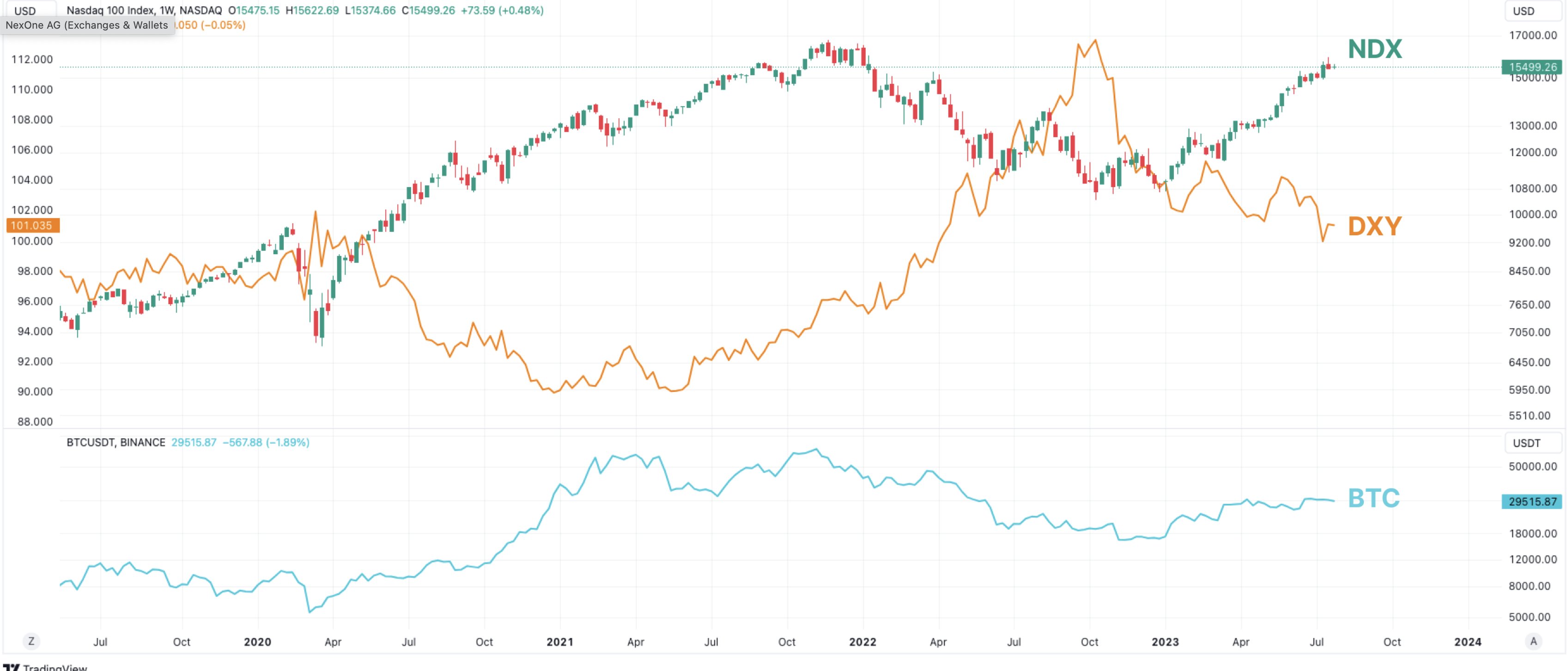

The pseudonymous analyst Negentropic his 55,800 Twitter followers that the U.S. Dollar Index (DXY) is losing steam, which he sees as a positive for Bitcoin.

Negentropic also notes that the Nasdaq 100 is nearing its all-time high, which it set in late 2021.

“Historical data indicates that when Nasdaq regains significant levels, BTC usually catches up within approximately 80 days. The process often starts with the Nasdaq cooling off as capital rotates towards riskier assets. Once the rotation occurs, the Nasdaq tends to take off again, propelling BTC’s rise.”

Additionally, the analyst discusses what traders should look out for as a confirmation of Bitcoin’s local bottom.

“We need BTC to hold above $29,300 and challenge the $29,700 level. On the upside, reclaiming $30,400 (our previous pivot point) could test [the] $30,800-$31,000 resistance area.

Remember the volumes around $23,000 earlier this year? Despite that, our bullish hypothesis remains intact. Multiple factors are supporting BTC’s upward movement, making a crash back to $23,000 or below less likely.”

Bitcoin is trading at $29,796 at time of writing. The top-ranked crypto asset by market cap is up more than 2% in the past 24 hours.