Over USD 1bn in long trading positions has been liquidated in the past 24 hours as overly optimistic traders seem not willing to learn after they lost almost USD 2bn just a week ago.

Almost USD 600m of those positions were in bitcoin (BTC). In the past hour alone (10:39 UTC), around USD 400m have been liquidated in total, while around USD 170m of those were positions in BTC that slipped today, prompting liquidations and the further sell-off.

At the time of writing, BTC trades at USD 54,735 and is down by more than 5% in a day, trimming its weekly gains to almost 12%. BTC reached its new all-time high of USD 58,641 (per Coingecko.com) this past Sunday.

Other major coins from the top 10 club are down by 6%-11% in a day, except XRP that suddenly rallied today but is also correcting gains.

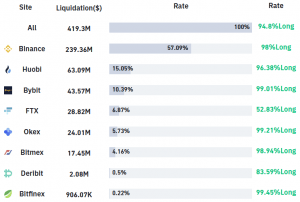

Meanwhile, similarly to the last week, major exchange Binance leads again - over 50% of the total liquidations in the past hour happened on this platform again.

Exchange liquidations in an hour:

As reported, long liquidations have become more numerous over the past month or so. With bitcoin (and other coins) breaking all-time highs nearly every passing week, some traders may feel unable to gain significant exposure without margin trading.

However, a growing number of traders can’t afford to maintain their leveraged positions in the event of dips. Hence, the growing frequency of big liquidations.

As reported, leveraged trading is the biggest risk to the crypto market in terms of what could cause “something to pop down the line,” according to Joey Krug, Co-chief Investment Officer at US-based major crypto investment company Pantera Capital.

He warned that some people get complacent when they realize crypto is here to stay. As a result, they lever up on it, thinking it can’t go down that much because institutions will swoop in and buy, saving the day. But eventually, when the lid blows off and bids are not there, liquidations of levered longs will drive the price down as just happened again.

Leveraged trading refers to borrowing funds so that you can take a larger position than you would be able to with your existing funds so that you can potentially generate a higher profit. However, while margin trading enables traders to amplify their returns, it can also lead to increased losses and liquidations, which is why experienced traders tend to advise newcomers to stay away from leveraged trading.

___

Reactions:

@cointradernik Is this just normal now?

— Low IQ ??????? (@CryptoChillDood)

#BTC updates from earlier this morning: expecting a further retrace to ~53k before it should regain strength for mo… https://t.co/uzGu1XrlxI

— Crypto_Ed_NL (@Crypto_Ed_NL)

Ideally leverage is supposed to amplify your positive expectancy asymmetrical trades.

— Loma (@LomahCrypto)

___

Learn more:

- What Are Leveraged Tokens And Should You Trade Them?

- Cryptoasset Margin Trading: How Safe is it?

- Crypto Traders Warn Newbies About New & Super Risky Binance Feature

___

(Updated at 11:05 UTC with an infographic.)