CryptoQuant chief executive Ki Young Ju thinks the US Bitcoin () market is in the driver’s seat regarding the immediate future of crypto prices.

Young Ju his 347,300 followers on the social media platform X that the US Bitcoin market “is more important than offshore global markets for the next leg up.”

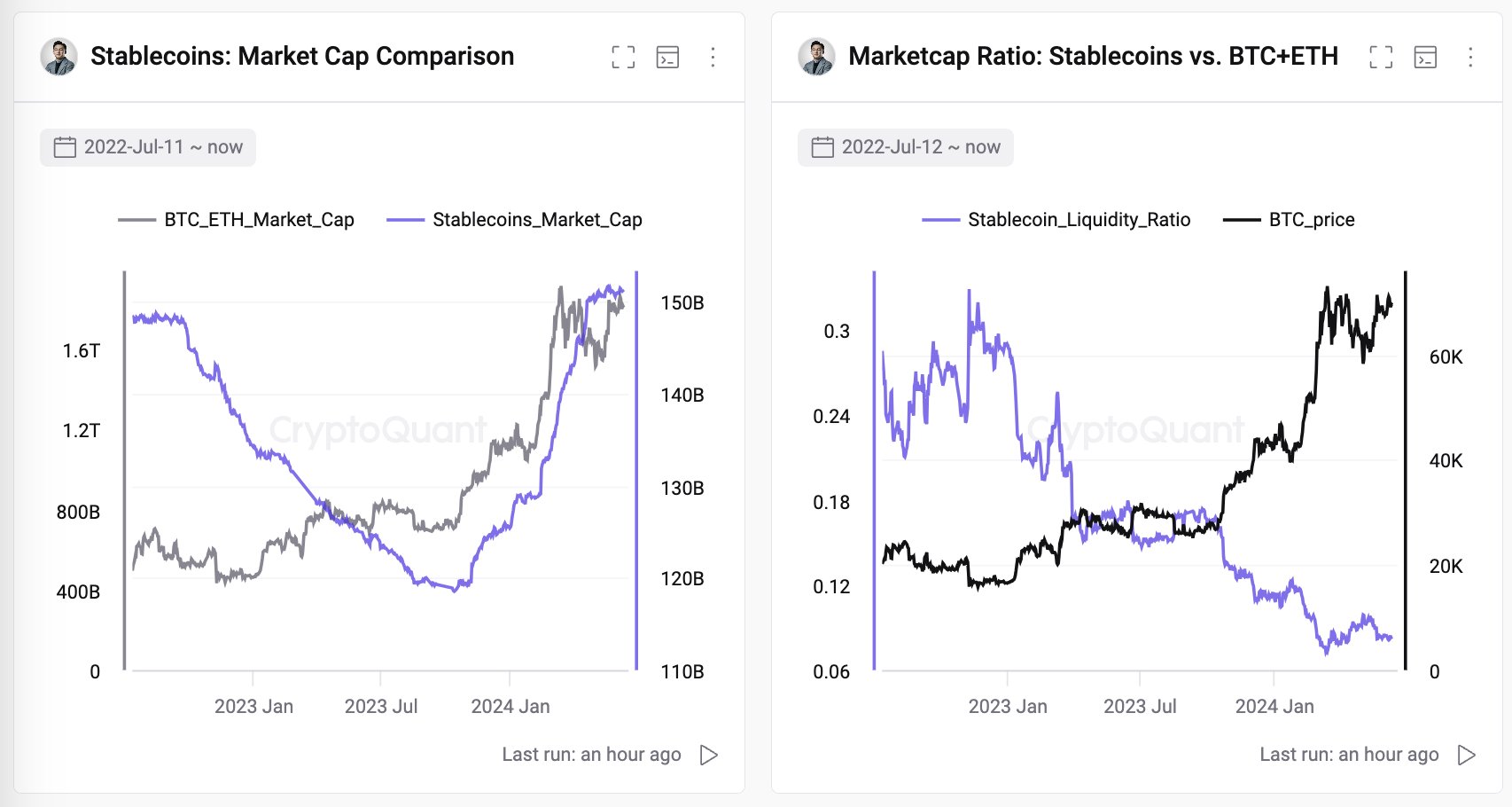

“Stablecoins are often seen as global offshore buy-side liquidity. Their market cap is growing, but the ratio to BTC and ETH market caps is decreasing. The same applies to free-floating market caps and exchange reserves. Stablecoins alone can’t drive the next market surge.

Coinbase holds a 46% dominance in global BTC-USD spot markets, with rising influence, likely driven by institutional brokerage services.

KRW (South Korean won) is the second largest fiat for trading volume, but mainly for altcoins. 82% of Upbit’s volume came from altcoins last month. Also, BTC-USD trading volume on COINBASE was five times larger than BTC-KRW on Upbit.”

BTC is trading at $68,312 at time of writing. The top-ranked crypto asset by market cap is down around 4% in the past seven days.

Earlier this week, Young Ju that Bitcoin isn’t currently overvalued from a network fundamentals perspective. Young Ju cites BTC’s “thermo cap ratio” as evidence.

Thermo cap represents the weighted sum of mined coins by the creation price, indicating the total investment cost in the Bitcoin network. The thermo cap ratio is Bitcoin’s market capitalization divided by the thermo cap, according to the CryptoQuant CEO.