Bitcoin has continued to hold at the pivotal $19,400 level amid an upward push for gains beyond $20,000. The stability witnessed above $19,000 over the last 24 hours suggests that Bitcoin has matured as an asset. Moreover, investors are also participating in the market with caution to ensure that their risks are minimized.

The flagship cryptocurrency is dancing at $19,400 while fighting to hold the ascending channel’s upper lower boundary support. It is vital that BTC closes the day within the confines of this channel to sustain the uptrend. Moreover, closing above the middle boundary will encourage more buyers to come from the sidelines, confident enough for gains above $20,000.

BTC/USD 4-hour chart

On the upside, Bitcoin could rally to $21,000 if it begins the price discovery above $20,000. The bullish leg might extend to $21,530 before a significant reversal plays out.

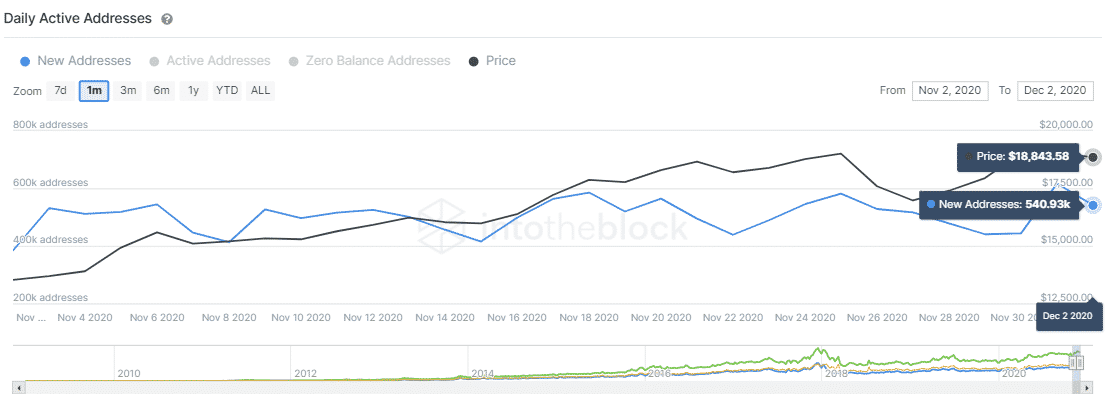

According to IntoTheBlock, Bitcoin’s network growth has been slowing down after topping 616,000 on December 1. The network growth on-chain indicator tracks the number of newly created addresses on a daily basis. It helps to foresee the growth of the network and the future price growth or declines.

A lower network growth suggests that adoption is going down and that losses are likely to come into the picture. The decrease interrupts the normal inflow and outflow of tokens on the network. BTC has recorded 540,000 new addresses that have joined the network in the last 24 hours, representing a 12% slump in less than five days.

Bitcoin IOMAP chart

Bitcoin will invalidate the uptrend if the network growth fails to recover soon enough. Besides, closing the day under the ascending channel would call for more sell orders. Losses that come into the picture might create enough volume to send Bitcoin to the confluence support created by the 50 SMA and the 100 SMA.

Bitcoin intraday levels

Spot rate: $19,390

Percentage change: -0.3%

Relative change: -58

Trend: Generally bullish

Volatility: Low