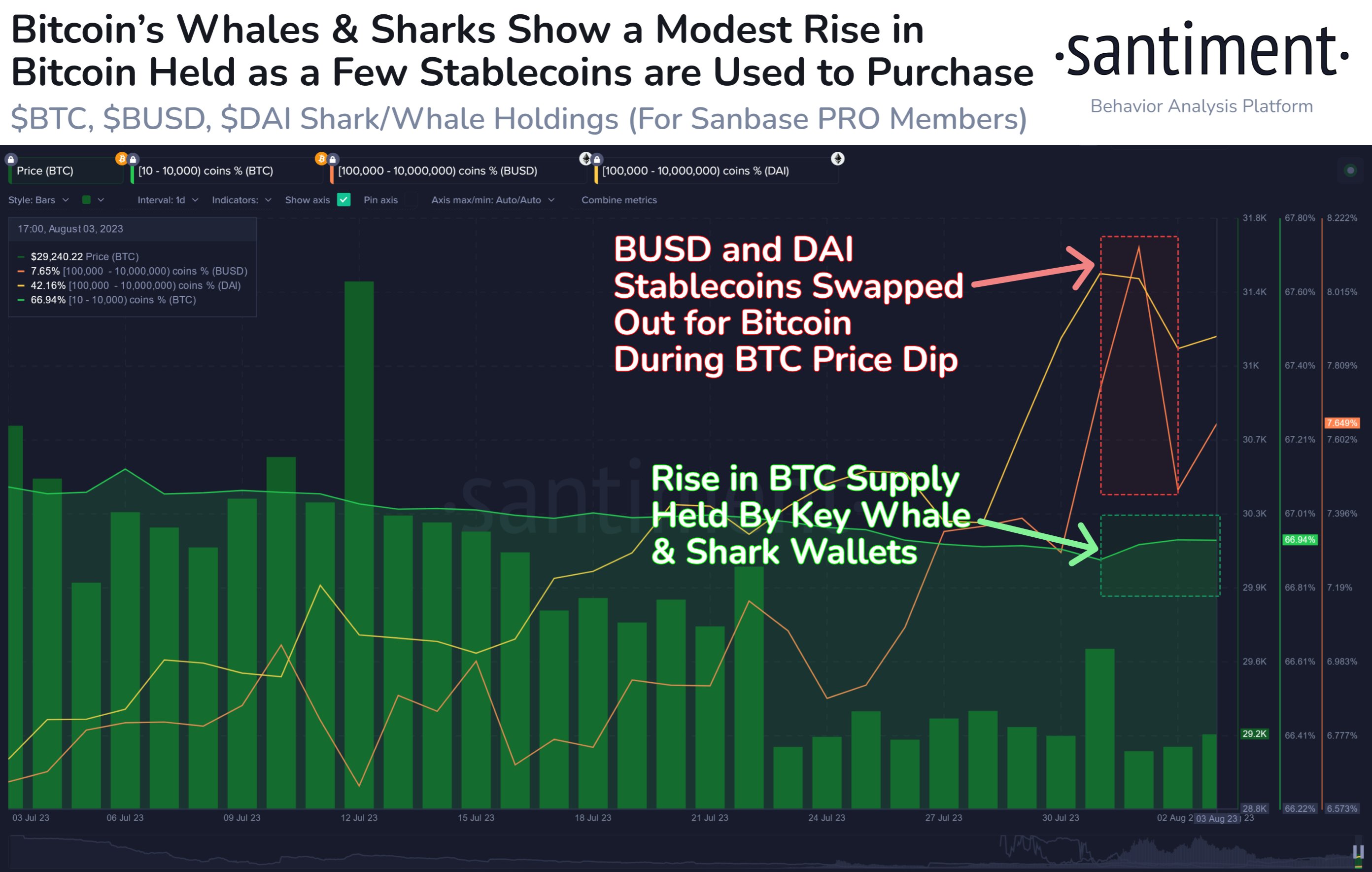

The crypto king could soon find itself over the $30,000 level if key holders continue the trend of swapping stablecoins for Bitcoin (), according to Santiment.

New data from the market intelligence platform reveals that Bitcoin whales are beginning to trade their stablecoins for the king crypto asset after months of decreasing their BTC stashes.

Santiment adds that BTC sharks have also started to accumulate the flagship crypto asset.

“After a month of whales mildly lessening their Bitcoin bags, we’ve seen some swapping of their stablecoins for more BTC. If this trend continues, we could see a quick rebound of prices back to $30,000 and beyond.”

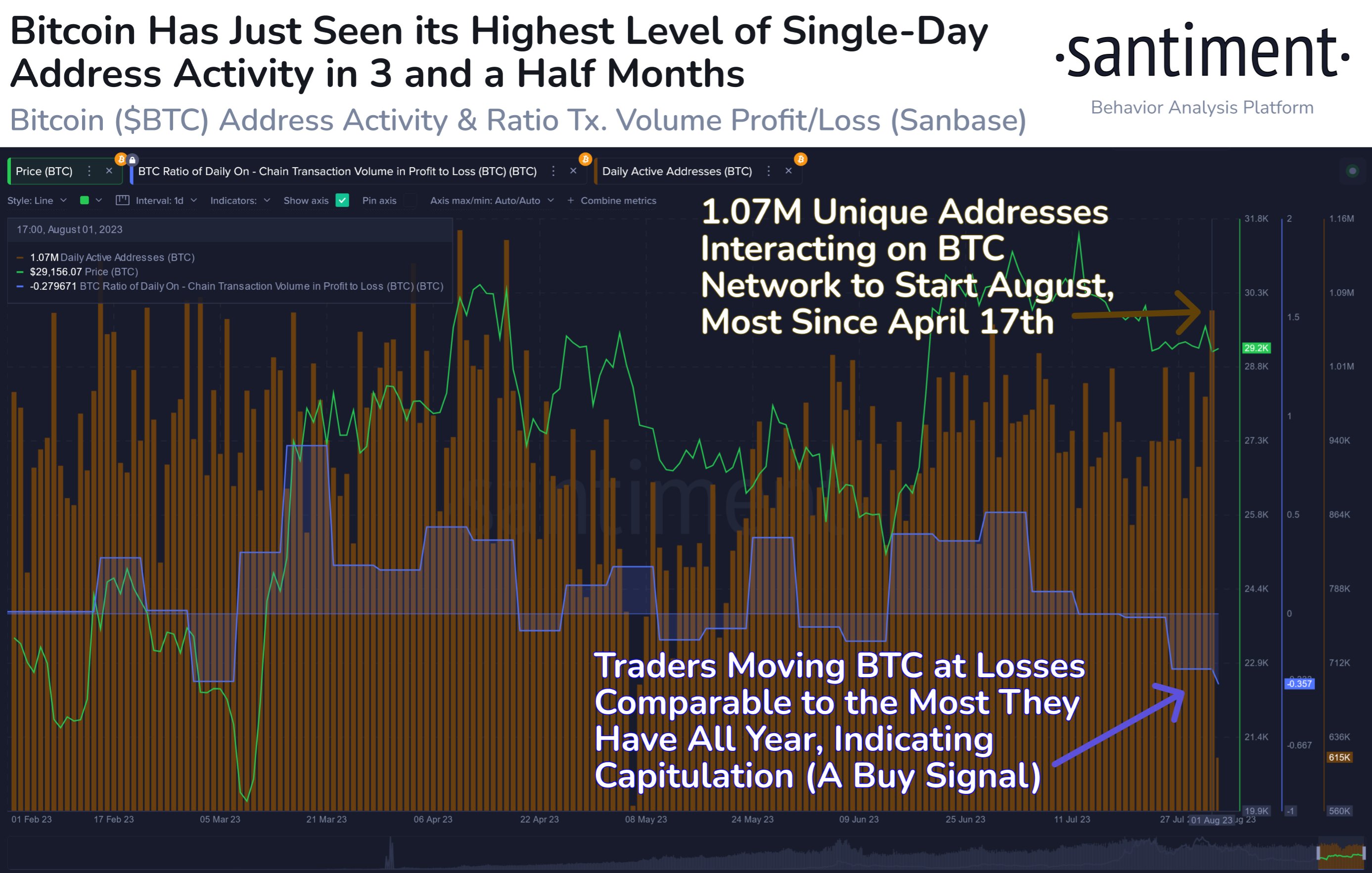

The crypto analytics firm also that Bitcoin’s address activity is at the highest level it’s been in months and that traders have been moving BTC at a loss. According to Santiment, these signals suggest that Bitcoin is primed to see a short-term price boost.

“Bitcoin’s address activity has surged to its highest level in 3.5 months in August. This utility increase, combined with major loss transactions and negative sentiment, is a strong sign that a short-term (at minimum) BTC price bounce is more probable.”

Bitcoin is trading for $29,121 at time of writing, a fractional decrease during the last 24 hours.

Santiment goes on to that traders should keep an eye on “polarizing topics,” such as the post-halving performance of the peer-to-peer payments network Litecoin () and the continuing enforcement actions of the U.S. Securities and Exchange Commission (SEC) against the industry.

According to the analytics firm, these narratives could influence the direction of the crypto markets.

“Keep an eye on polarizing topics like Curve, RWA (real-world assets), and the Litecoin halving price performance as the week comes to an end. These topics, alongside continued exchange and SEC drama, are what will drive markets up or down for the time being.”