The artificial intelligence (AI) sector is witnessing a resurgence in speculative investments, with related crypto tokens experiencing unprecedented highs. This revival is closely tied to the soaring performance of major AI stocks, particularly Nvidia (NVDA), which has become a cornerstone of AI optimism in the stock market.

The growth of AI-focused stocks is permeating into the crypto market, where many AI tokens are close to setting new long-term highs.

AI Crypto Tokens Flex Big Gains

AI sentiment in the crypto sector has been overwhelmingly positive, especially in the past few months. Recent CoinGecko research even pointed to AI as the most popular crypto narrative in 2023. And this optimism is still going strong in 2024 and is reflected in the price movements of major AI-related tokens.

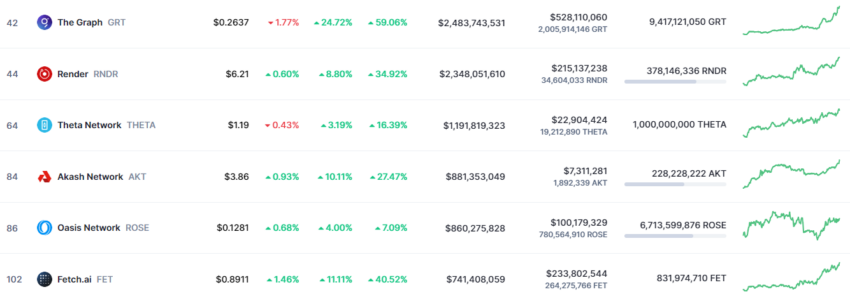

Many of the biggest movers are tokens in the top 100 cryptocurrencies by market cap. In the past week alone, many of these AI tokens have soared by more than 25%. Others, like Arkham’s ARKM token, have more than doubled in price in the same period.

The Graph (GRT), currently ranked 42 in terms of market cap, has enjoyed an almost 60% gain this week. It briefly breached the $0.27 level before dropping back slightly.

Another notable mover is Render (RNDR). Render first blasted into the crypto market’s top 50 at the end of 2023, following a 1,100% gain on the year.

RNDR reached an all-time high near $7.50 in November 2021 but quickly sank to $0.40 in the bear market that followed. RNDR is currently trading at $6.20, almost 15% away from setting a new all-time high milestone.

Boost From TradFi Markets

Big AI players in traditional finance, like Nvidia (NVDA) and Super Micro Computer Inc (SMCI), are causing a ripple effect, causing a surge in AI tokens.

Since the beginning of the year, Nvidia shares have surged by over 46%, a growth that has not only outpaced its peers but also significantly contributed to the S&P 500’s increase.

Keith Lerner from Truist Advisory Services highlights this surge, stating,

“When people say that the market is doing well this year, they really mean that tech is doing well, and Nvidia is at the core of that.”

The chipmaker’s upcoming earnings report on February 21 is eagerly anticipated, with Wall Street expecting substantial earnings and revenue growth.