Citigroup is reportedly in collaboration with Wellington Management and WisdomTree, is actively exploring the concept of utilizing Avalanche to tokenize private equity funds.

This initiative reflects the broader trend within the crypto industry, where major banks worldwide are delving into tokenizing real-world assets, sparking significant discussion.

Citigroup Explores Avalanche Blockchain Network

A recent report indicates that Citigroup is currently testing the implementation of tokenizing privat equity funds on the Avalanche blockchain network.

“Citigroup Inc. has carried out a simulation which shows how a private equity fund can be tokenized on a blockchain network, potentially paving the way for greater adoption of distributed LEDGER technology on Wall Street.”

In September 2023, Citi launched a digital-asset service. The banking group teamed up with Trade Solutions and Maersk to make a range of blockchain-based digital services available for institutional clients

Banks are starting to acknowledge blockchain’s legitimacy following the United States Securities and Exchange Commission’s (SEC) approval of 11 spot Bitcoin exchange-traded funds (ETFs) on January 10.

Furthermore, the approval enables major asset management firms like BlackRock and Grayscale to provide spot Bitcoin ETF products to clients.

On January 12, BeInCrypto reported that Staci Warden, the CEO of Algorand, believes tokenizationcould ensure that crypto survives

Global Tokenized Market Surge

Various asset types are eligible for tokenization, such as real estate, art, precious metals, cars, and carbon credits.

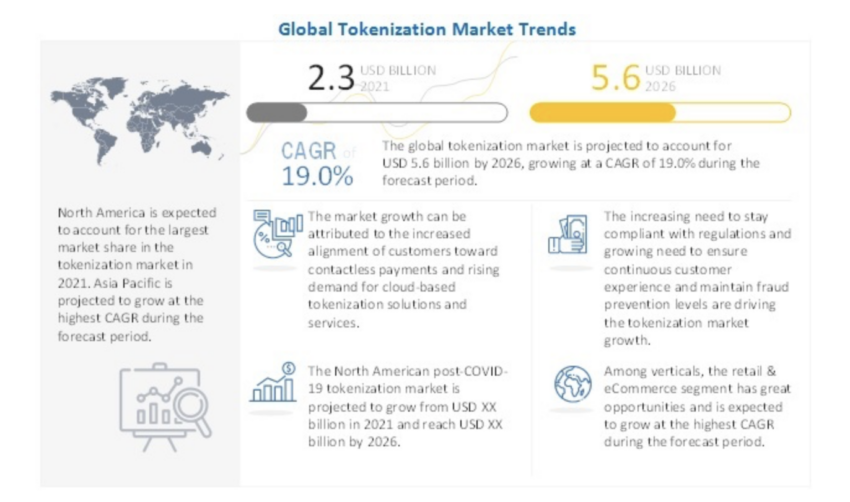

Markets and Markets projects the global tokenization market to reach $5.6 billion USD by 2026. It noted that the North American market currently holds the lion’s share.

Furthermore, in September 2023, one of Australia’s major banks, the Australia and New Zealand Banking Group (ANZ), recently announced its adoption of Chainlink’s cross-chain interoperability protocol (CCIP).

This was adopted for simulating tokenized asset purchases.

However, the Hong Kong Securities and Futures Commission (SFC) recently outlined potential requirements for the tokenization of investment products.

“Tokenization of investment products refers to the creation of blockchain-based tokens that represent or aim to represent ownership in an investment product.”