Prime Trust may be taken over by the state of Nevada, and the situation seems alarming.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. to sign up for future editions.

The narrative

Prime Trust owes customers more than $80 million in cash that it doesn’t have, court filings this week showed.

Why it matters

Prime Trust, a storied crypto custodian, is only the latest digital asset firm to acknowledge financial issues and face a takeover. But as a custody provider, it occupies a unique space among the various bankruptcies we’ve seen so far.

Breaking it down

On June 8, 2023, my colleague Ian Allison reported that BitGo, a crypto custodian that’s vacuumed up other companies in the past, had begun the process of acquiring Prime Trust, a fellow custody provider.

On June 22, i.e. two weeks later, BitGo walked away from this deal.

That same day, rumors emerged that the state of Nevada had filed a cease-and-desist against Prime Trust, which the state later confirmed by publishing an order which alleged it had a massive deficiency of customer funds and indeed may be insolvent.

Four days after that, the state of Nevada took things a step further, filing for receivership (basically asking for court approval to take over the company) and alleging that Prime Trust a) owed clients about $82 million in fiat that it didn’t have access to and b) lost access to certain crypto wallets in 2021 and so was using customer fiat funds to buy crypto to meet withdrawal requests.

This filing, which was made public on Tuesday, is pretty alarming. It’s got sign-off from Prime Trust’s interim CEO and board, indicating the company is cooperating with the state Financial Institutions Division.

It’s also worth noting that Prime Trust has changed leadership a few times since its founding. The allegations indicate that the custodian used wallets it lost access to in 2021, prior to the current interim CEO’s appointment.

Still, this appears to be the first time these revelations are being publicly disclosed, and the implications are serious.

One of these implications ties to the possible impact to TrueUSD, a stablecoin whose issuer said on June 22 it had “no exposure” to Prime Trust before later acknowledging it had a relatively small amount ($26,000) on the custodian.

Rumors that TrueUSD use Prime Trust to mint and redeem tokens have persisted though, and the token even depeggedBinance.US on Wednesday.

Lawmakers are already paying attention to stablecoin issues, and a bill addressing this sector of the crypto industry is still the most likely to pass through the House before other legislation, so I imagine Congress will take notice if one of the world’s largest stablecoins continues to have issues.

And regulators will of course be paying attention to issues by a regulated custodian.

- Judge Rejects FTX Founder Sam Bankman-Fried's Motions to Dismiss Criminal ChargesA federal judge denied Sam Bankman-Fried’s motions to dismiss most of the criminal charges, arguing that he didn’t have standing or make a compelling argument on the different motions.

- EU Seals Deal on Crypto Bank-Capital Rules: The European Union has set up a political deal to address bank capital requirements for various assets like corporate and home loans. Crypto is included.

- Leading House Democrat Solicits Feedback From Gensler and Yellen on Crypto BillRep. Maxine Waters, the ranking member on the House Financial Services Committee, asked Treasury Secretary Janet Yellen and SEC Chair Gary Genlser to weigh in on the proposed crypto market structure bill.

- 2020 Twitter Hacker Sentenced to 5 Years on Crypto Theft, SIM Swapping Scheme: Joseph O’Conner, otherwise known as PlugWalkJoe, i.e. one of the people arrested for hacking Twitter and taking over accounts to promote a bitcoin scheme in 2020, was sentenced to five years in prison, with 28 months served.

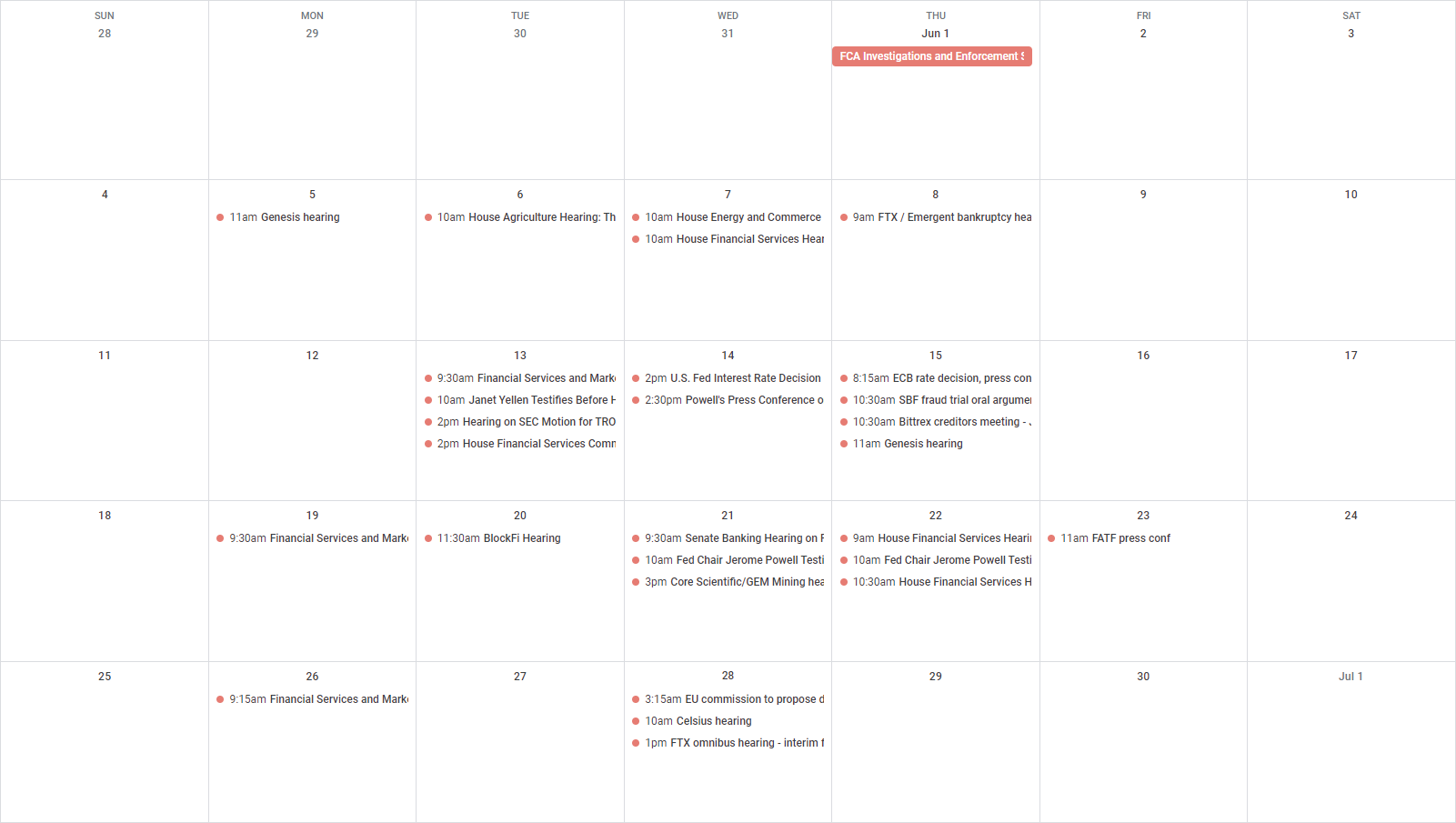

This week

- 13:15 UTC (2:15 p.m. BST) The U.K.’s House of Commons considered amendments to its Financial Services and Markets Bill.

Wednesday

- 7:15 UTC (9:15 a.m. CEST) The European Commission published its digital euro bill.

- 14:00 UTC (10:00 a.m. ET) There was a Celsius bankruptcy hearing.

- 17:00 UTC (1:00 p.m. ET) The FTX bankruptcy hearing was actually canceled.

Elsewhere:

- (Bloomberg) Bloomberg filed a Freedom of Information Act request to the Federal Deposit Insurance Corporation for documents tied to its rescue of Silicon Valley Bank, finding that stablecoin issuer Circle was its largest depositor (with $3.4 billion in the bank). Sequoia Capital also had north of $1 billion that the FDIC protected.

- (Bloomberg) Venezuela temporarily banned crypto mining, which is not great news for the local crypto industry.

Bitcoin ETF filings… pic.twitter.com/65jxTP6S39

— Nate Geraci (@NateGeraci) June 22, 2023

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at [email protected] or find me on Twitter .

Story continues below

Recommended for you:

- Abu Dhabi: A Wealthy Middle-East Capital Creating a Bridge From TradFi to Crypto

- TrueUSD’s Reserves Were Attested by Former FTX.US Accounting Team

- A16z, ARK Invest Back $37M Round for Mythical Games

You can also join the group conversation on .

See ya’ll next week!