French banking giant Societe Generale is launching a euro-pegged stablecoin on Bitstamp. The coin will allow its clients to explore the digital asset marketminus the limitations of private networks like JPM Coin offered by JPMorgan.

The stablecoin, EUR CoinVertible, will be listed on the Luxembourg-based exchange. The launch is a significant milestone since it is the first time a traditional bank is dipping its toes into an industry dominated by niche companies.

There Is a Place for a Euro Stablecoin: Societe Generale

CEO Jean-Marc Stenger believes that “there is a place for a bank in this field and there is a place for a euro [denominated] stablecoin” in a market dominated by US dollar-backed equivalents. The asset will be used, among other things, to settle trades in digital bonds, funds, and other assets.

Read more: What Is a Stablecoin? A Beginner’s Guide

To allay liquidity fears, Stenger confirmed that customers would have recourse regarding the assets backing the stablecoin. A third party will handle the collateral, he confirmed. The asset will also fully comply with the European Union’s (EU) Markets in Crypto-Assets (MiCA) bill, which will come into effect next year.

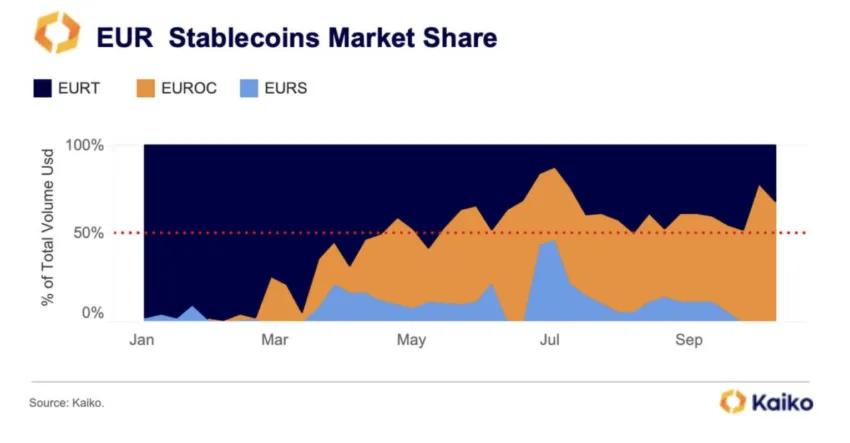

The new coin will test European appetite for stablecoins. Negative interest rates have hampered Euro-denominated stablecoins since they hurt yields crypto platforms can offer depositors. EURC, a stablecoin launched by Circle in June 2022, has accrued the highest market share over rivals EURT and EURS.

Read more: 10 Platforms That Provide the Best Interest Rate on Stablecoins

The continued lack of regulatory clarity for stablecoins in the US contrasts with the clear guidelines outlined in MiCA. Upon its enactment, MiCA may assuage fears of a liquidity crisis that affected the issuer of the USDC stablecoin in March. Europe may then become a viable test bed for the promised improvements stablecoins can bring to traditional banking.

Tokenized Bank Currency Not Popular

Up to this point, tokenized fiat bank settlements have only benefited select parties. JPMorgan recently launched a euro-denominated version of its JPM Coin for institutional customers.

As of November, volumes of its US-dollar and euro JPM Coin settlements were $1 billion daily, a tiny slice of the $10 trillion the bank processes daily. Despite the low demand, the bank’s Global Head of Financial Institution Payments, Umar Farooq, hopes that number will increase to $10 billion over the next year or two.

The European Central Bank proposed a digital euro but was opposed for fear of surveillance. Despite this, it recently ramped up efforts to build a conceptual foundation for the central bank digital currency.

Do you have something to say about the new Societe Generale euro stablecoin, MiCA, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on FacebookX (Twitter)