Bitcoin appears to have a clear path to the coveted $20,000. However, attempts to break out to the higher levels have proved unsuccessful in the last 48 hours. Resistance has continued to intensify under $19,500.

At the time of writing, BTC/USD is teetering slightly above $19,000 amid developing bearish pressure. The desire among the bulls is to hold above the ascending parallel channel’s lower boundary support.

However, the most probable price action is to drop toward $18,000 before a significant reversal comes into the picture. Beneath, $19,000, the 50 Simple Moving Average and the 100 SMA on the 4-hour chart are in line to offer support and absorb some of the selling pressure.

BTC/USD 4-hour chart

Short term technical analysis reinforces the bearish technical picture with the Relative Strength Index gradually moving towards the midline. Moreover, it is doubtful that the channel’s lower boundary support will stay intact, especially now that sellers are pushing to regain full control over the price.

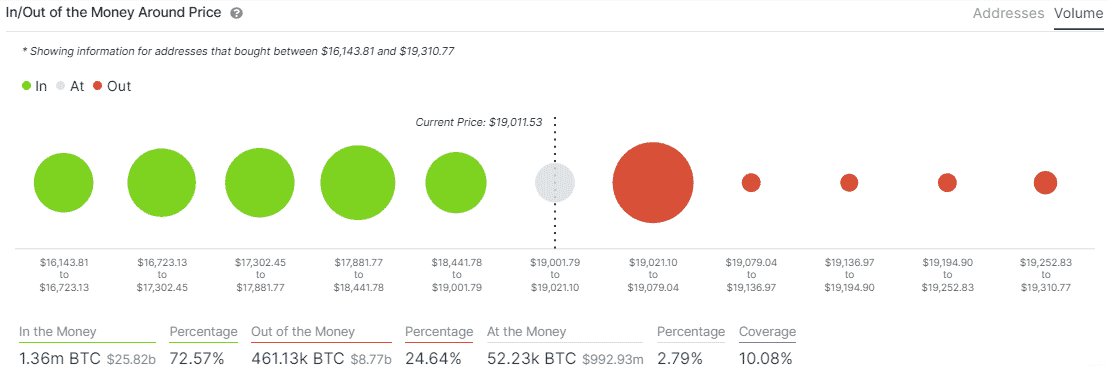

Meanwhile, IntoTheBlock’s IOMAP chart reveals that the flagship cryptocurrency is facing a tough resistance between $19,021 and $19,079. The seller congestion must be weakened before BTC blasts massively to $20,000. Here, nearly 694,000 addresses had previously bought roughly 458,000 BTC.

Bitcoin IOMAP model

On the downside, the king of cryptocurrencies is sitting on areas with immense support, likely to invalidate the bearish outlook eyeing $18,000. For now, the most robust anchor zone lies between $17,882, $18,442. Here, approximately 579,000 addresses had purchased nearly 368,000 BTC. Therefore, consolidation might take precedence between $18,500 and $19,000 before a significant breakout comes into the picture.

Bitcoin intraday levels

Spot rate: $19,050

Relative change: 170

Percentage change: -0.9%

Trend: Bearish

Volatility: Low