Banks claim tokenization improves liquidity and lowers costs for businesses. But the transfer speed of physical assets is often slow and, according to real estate company Steelwave, weighed down by outdated laws.

Methods like fractionalizing can improve on-chain liquidity but have nontrivial legal concerns. Take commercial real estate, for example.

A $100 million commercial real estate plot may be financed through $50 million equity and a $50 million loan. Splitting equity into large chunks results in capital inefficiency since shares can only be liquidated at steep discounts until a property is sold.

Mitch DiRaimondo, a project manager at real estate company Steelwave, argues the key lies in making the shares smaller. In what he claims is an industry-first effort, his company splits assets into tradable securities to improve liquidity.

Distinct from cryptocurrencies, these assets trade at net asset value determined by market conditions. As a result, their prices don’t follow supply and demand dynamics.

So far, American investors have been skeptical. But stakeholders in the Middle East, Israel, and Europe, eyeing US real estate, have cottoned onto the idea.

But is the hype justified? And will Steelwave succeed? Let’s find out.

Liquidity Benefits of Tokenization in Real Estate

According to DiRaimondo, Steelwave’s efforts differ little from the tokenization of fiat currency. In the case of money, digitization improves liquidity without fundamentally changing the asset’s value.

So far, several countries have tried central bank digital currency (CBDC) pilots that exchange fiat over custom networks. Earlier this year, the Bank of England tested exchanging tokenized assets using a Real-Time Gross Settlement system.

The project synchronized LEDGER entries related to the exchange of a real-world tokenized asset for a form of digital money. The pilot precedes a real-time settlement system the bank will launch next year.

Earlier this year, German banking giant Deutsche Bank applied with local regulators to tokenize investments. Goldman Sachs facilitated the first purchase of a Euro-backed tokenized bond by electronics giant Siemens AG.

US Laws Push Steelwave Offshore

But the tokenization space is far from mature. Regulatory uncertainty has cast doubt on the viability of digital asset businesses in the US.

As DiRaimondo affirms, its business challenges existing tax, entity, and structuring laws in the US.

“At its core, the real estate asset remains constant. The shift lies in the digitized ownership structure and the newfound ability for owners to seamlessly trade their stakes in an environment devoid of traditional barriers.

The lack of clarity pushed Steelwave to Bermuda, where it sought to be regulated by established digital asset laws. It procures investments in a fund to buy fully-leased US real estate.

Investors can convert their shares into digital securities after Steelwave confirms ownership of the assets. The process ensures those who opt-in get access to secondary market liquidity.

According to DiRaimondo, Steelwave Digital is hoping to modernize laws to conform with evolving technology.

“Steelwave Digital, our subsidiary, is pioneering the integration of conventional institutional real estate ownership with the emerging digital security ecosystem.”

Tokenization Must Overcome Hurdles Before Going Mainstream

Earlier this year, Citibank predicted users would only benefit from tokenization when blockchains become ubiquitous. For now, though, end-users may struggle with the value proposition.

“Successful adoption will be when blockchain has a billion-plus users who do not even realize they are using the technology.”

The bank identifies decentralized identities, zero-knowledge proofs, oracles, and secure bridges as technologies needed to bridge blockchains with the real world. These technologies have either had reputations marred by exploits or remain out of the mainstream at the time of writing.

Worldcoin’s iris-scanning technology has made some breakthroughs in decentralized identities. However, the project has sparked privacy concerns from regulators in the countries it has launched in. Its technology is also open to abuse, according to Ethereum co-founder Vitalik Buterin

Several communities launched projects using zero-knowledge proofs, technologies that scale the transaction processing on congested chains. By and large, the technology remains expensive, and while developer StarkWare uses so-called zk-STARK technology to reduce the cost of “proving,” it remains the most expensive part of the technology.

Interested in the exciting subject of zero-knowledge proofs? Read our deep dive

Oracles, which bring outside data to the blockchain, can be manipulated.

Security audits are helping bridges smoke out bugs that cost decentralized finance over $2 billion last year. Bridges are smart contracts that exchange tokens between blockchains.

Without bridges, the transfer of assets can only occur between clients of the same institution. Alternatively, the asset transfer could occur across a public blockchain presenting risks companies may consider untenable.

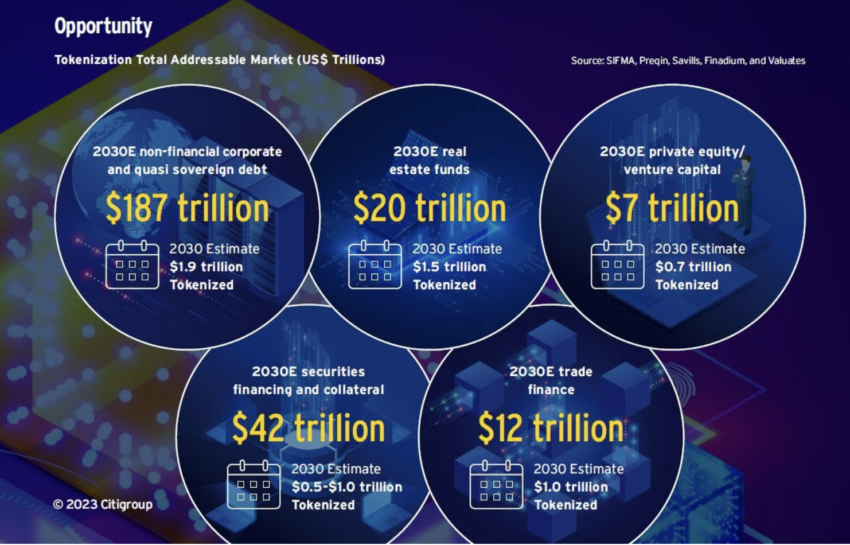

Assuming these four technologies are proven, Citi estimates that the tokenization of securities will be worth $4-5 trillion by 2030. On the legal front, where Steelwave has experienced significant hurdles, Citi argues for legally binding smart contracts

Exchanging these smart contracts over blockchains could create an immutable ownership trail for a tokenized asset.

“They are dynamic, connect to outside data sources, and allow for human involvement where necessary.”

Federal Laws Will Say Whether Americans Profit From Liquidity Benefits of Tokenization

But for now, the state of ownership and securities laws for digital assets remains uncertain. The US Securities and Exchange Commission (SEC) has denied the need for additional rules on cryptocurrencies and other digital assets.

The legal issues surrounding fractional ownership could benefit from laws Custodia Bank CEO Caitlin Long helped develop in Wyoming. Informed by the state’s property laws, they give users the ownership of their crypto assets protected by keys they possess.

But ultimately, the federal government needs to decide whether asset tokenization will define the future of American investing.

Got something to say about the liquidity tokenization affords real estateor anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on FacebookX (Twitter)

218

218