In retrospect, the second quarter of 2023 emerges as an especially intriguing period for the dapp industry. This period was characterized by the burgeoning interest in Decentralized Finance (DeFi) as it occupied an undeniably substantial segment of the industry’s attention.

However, the landscape was not limited to DeFi alone. The latest on-chain gaming data analysis provided by DappRadar for Q2 of 2023 paints an optimistic picture of the industry’s potential for growth and advancement, underlining areas beyond the realm of finance.

??The analysis underscores the gaming sector’s pivotal contribution to driving innovation and progress within the industry, demonstrating the dynamic and expansive nature of the field.

Key Takeaways

- Blockchain gaming activity in Q2 2023 had an average of 699,956 daily Unique Active Wallets, a decrease of 12% from the previous quarter.

- Alien Worlds and SPLINTERLANDS were the top games in terms of user activity on their respective blockchain platforms, with Alien Worlds dominating 61% of WAX activity and Splinterlands claiming 91% of Hive activity.

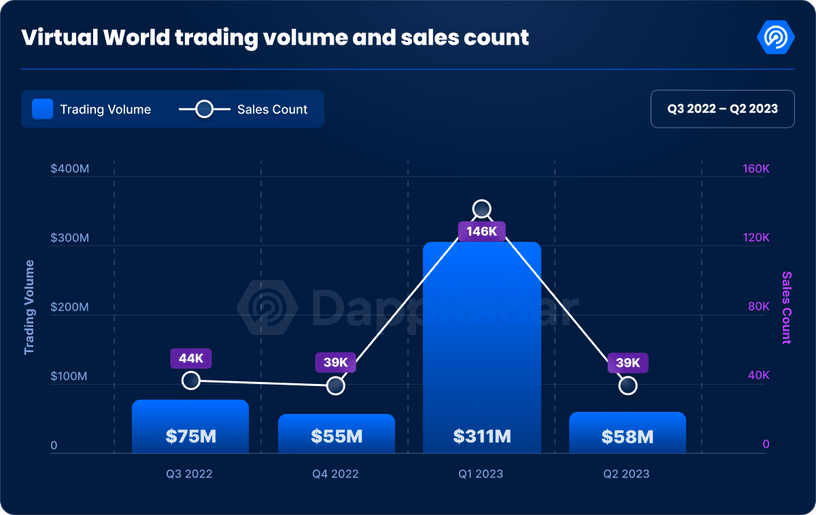

- This quarter showed a significant downturn in the metaverse dapps landscape, as trading volumes dipped by 81% to $58 million, and land sales decreased by 73% to just 39,000.

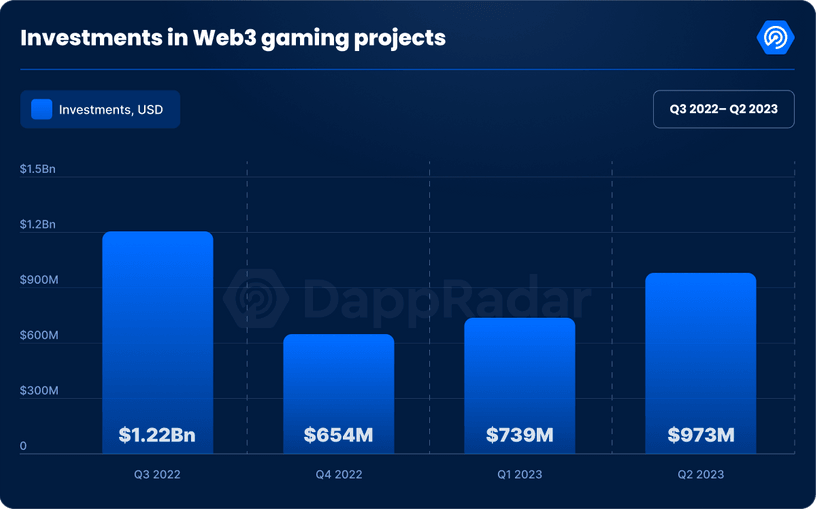

- Investments in blockchain gaming and metaverse projects increased by 31% from Q1 2023 to reach $973 million.

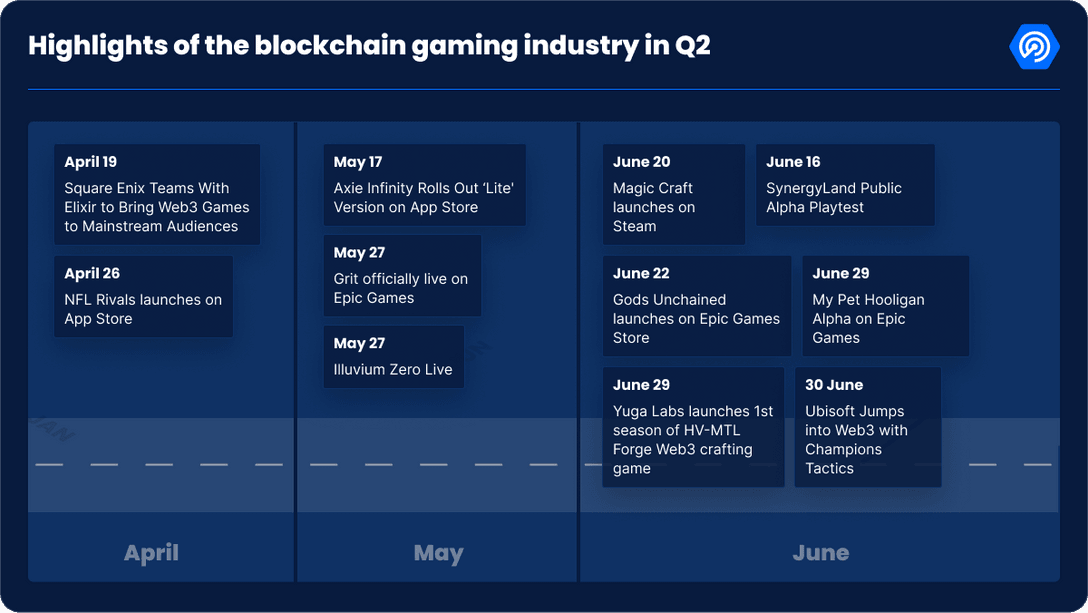

Highlights of the blockchain gaming industry in Q2

Blockchain Gaming Overview Q2

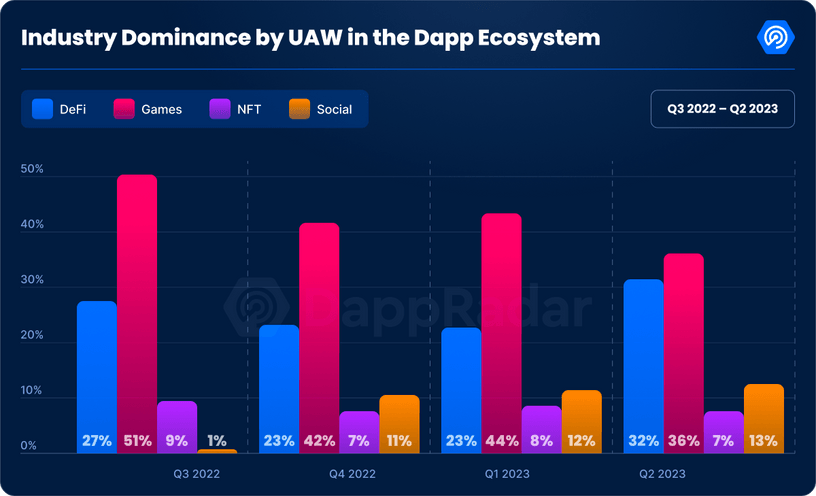

Despite reaching its lowest market dominance since Q3 2021, blockchain gaming remains a driving force in the dapp industry. As of Q2, it accounts for 699,956 daily unique active wallets (dUAW), representing 36% of total industry engagement. This reflects a 12% decrease from last quarter.

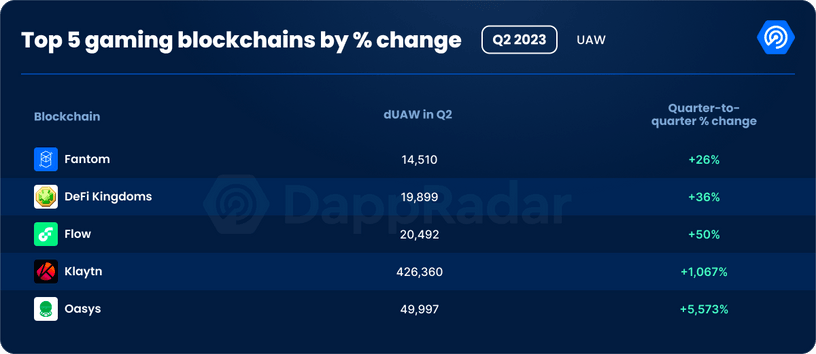

Among the top five blockchains with the highest percentage change in Unique Active Wallets were Klaytn, with an impressive 1067% increase and a dUAW of 426,360, and , with an astounding 5573% surge and a dUAW of 49,997.

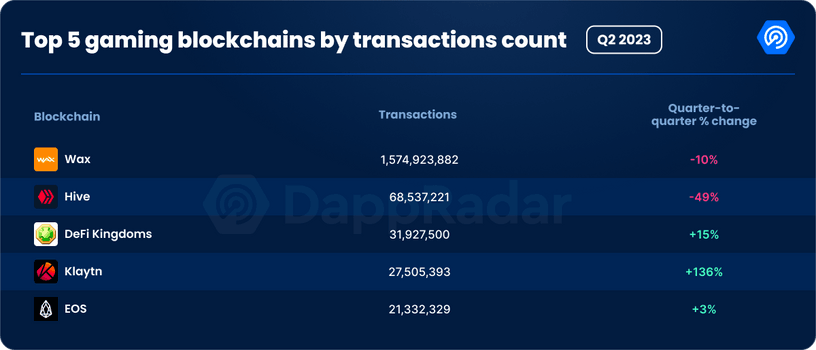

The blockchain with the highest number of transactions was WAX, with a total of 1.5 billion transactions. However, it experienced a 10% decrease in comparison to the previous quarter. Hive followed with 68.5 million transactions, representing a significant decline of 49%. DeFi Kingdoms saw a positive growth of 15% with 31,927,500 transactions. Klaytn demonstrated remarkable progress with a 136% surge, reaching 27,505,393 transactions.

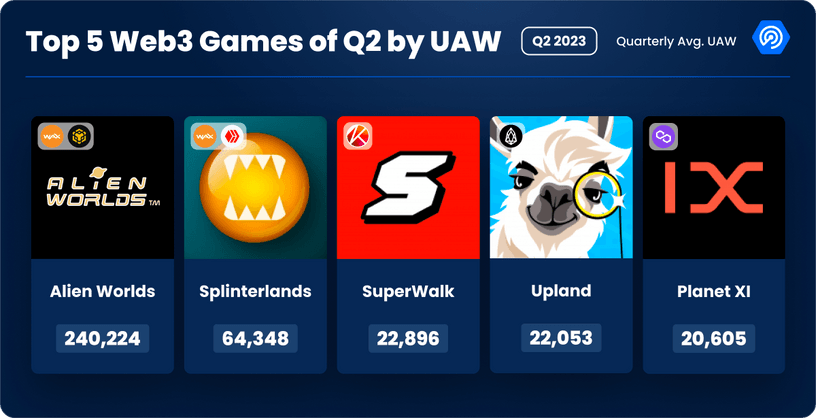

Top 5 Games of Q2 2023

In Q2 2023, Alien Worlds led the blockchain gaming industry with 240,224 UAW, followed by Splinterlands at 64,348 UAW. SuperWalk, a rising star in the move-to-earn trend, secured third place with 22,896 UAW. Consistent performers Upland and Planet IX rounded out the top five, averaging 22,053 and 20,605 UAW respectively. The ascendancy of SuperWalk suggests a strong move-to-earn trend resurgence in Q3 2023.

Furthemore, the top five Web3 games based on NFT trading volume witnessed significant activity. Gods Unchained led the pack with a total NFT trading volume of $6.3 million and 85,182 sales. Cross The Ages followed with a trading volume of $307,525 and 7,312 sales.

Virtual World projects

Q1 2023 brought unprecedented growth for digital land trades, with a 277% surge to a remarkable $311 million in trading volume. This period, boasting the highest land trades of 146,690 since the Terra Luna crash in May 2022, marked a peak in virtual world performance. However, Q2 painted a contrasting picture, with trading volume declining by 81% to $58 million and land sales witnessing a 73% drop to 39,000.

Investments in Web3 games

Investments in web3 gaming projects in Q2 2023 totaled $973 million, which represented a 31% increase from Q1 2023. The quarter’s standout investment was Bitkraft’s $221 million fundraise for its second token fund, as per an SEC filing. The gaming-specialized venture capital firm, with a history in supporting esports and game developers, aims to lend similar support to web3 gaming.

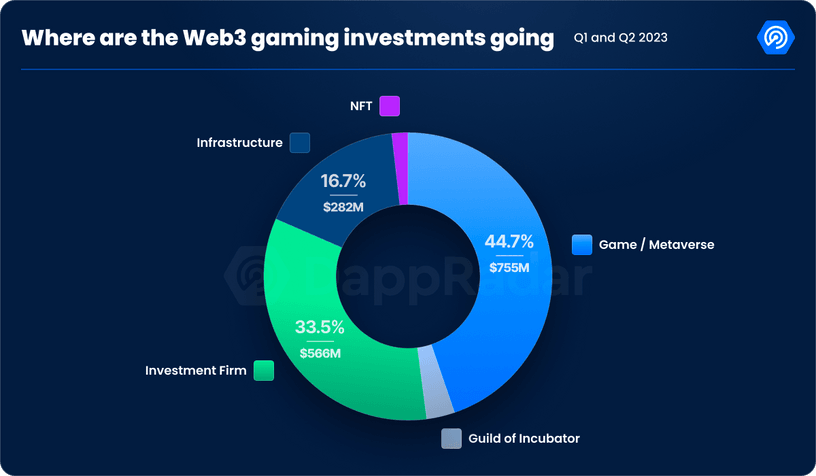

The majority of funds were directed towards Game/Metaverse projects, which received approximately 44.76% of total investments, or about $755 million. Investment firms represented the second largest recipient, securing around 33.54% of the funds, equating to $566 million. Infrastructure projects also received significant attention, drawing in roughly 16.73% of investments, or about $282 million. In contrast, Guild or Incubator and NFT sectors remained less favored, receiving only around 3.16% and 1.81% of total investments respectively, or $53.3 million and $30.5 million.

Conclusion

The Q2 of 2023 provided an interesting landscape in the industry of blockchain gaming and the metaverse, offering insights into the complex interplay of factors that define this dynamic sector.

Daily Unique Active Wallets in blockchain gaming registered an average of 699,956, marking a 12% dip from Q1. Despite the gentle ebb in overall gaming activity, Alien Worlds and Splinterlands remained hotspots of user engagement on their respective platforms – WAX and Hive, commanding 61% and 91% of the activity, respectively.

The metaverse, often hailed as the next frontier in digital interaction, demonstrated a somewhat quieter phase this quarter. Trading volumes saw a rather steep decline of 81% to land at $58 million, and land sales receded by 73%, amounting to a modest 39,000. While the figures do suggest a cool-off in metaverse dapps landscape, it’s crucial to look at the bigger picture.

Despite a seemingly tepid quarter in certain aspects, there’s a silver lining worth noting: investor confidence has been far from waning. Investments poured into blockchain gaming and metaverse projects soared by 31% from Q1 2023, amounting to a hefty $973 million. This surge in investments, against the backdrop of a quiet quarter, paints a rather optimistic narrative for the future.

So, while Q2 had its share of highs and lows, the uptick in investment activity underscores the sector’s resilience and potential, suggesting that this temporary slowdown might just be the calm before the storm of progress and innovation.