Hey folks, I’ve written before about how — “the Bridge Ethereum Deserves” — is one of the best bridges out there, yet now as we’re starting to go into 2024, Across has been absolutely killing it with…

?1000s of daily users

?10s of thousands of dollars in daily fees

?Easily more than half a billion dollars in transacted volume in January alone

?Winning second place, the only non-DEX-aggregator to do so in Clique’s Battle of the Bridges:

In today’s article I’m going to be talking about why Across has become parabolically popular, and why it’s one of the first places where many now go to conduct their Ethereum/L2 bridges.

The cheap even got cheaper

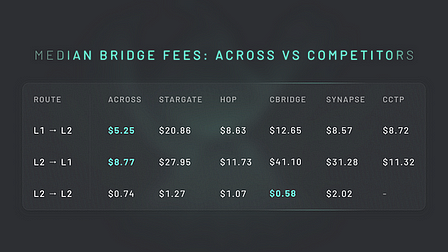

Perhaps the foremost consideration that most people probably take when they’re bridging are the fees. After Q2 last year, Across had already proven themselves as providing the lowest median fees across all major competitors when bridging back and forth from Ethereum mainnet and to different L2s:

Since the beginning of last December, users have been able to get even more returns on top of these cheap fees as Across has been essentially giving out $OP rebates of up to 95% when bridging to the Optimism L2:

Even though these incentives have been going on for nearly two months, there’s still reportedly nearly 700k $OP left. This indicates two things —first, the transfers on Across are extremely cheap as is, so it hasn’t been eating that much into the $OP supply, and second, at this rate users might be able to get rebates on their bridges for the rest of 2024!

Nearly twice the #realyield

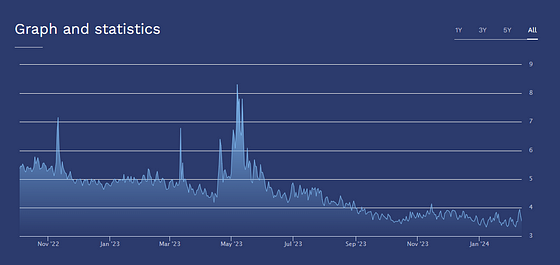

Speaking of low gas fees, one of the ways in which Across is able operate so efficiently is due to their single-sided liquidity pool with an interest rate fee model which keeps most of the their liquidity on Ethereum mainnet. Other competitors such as Stargate Finance fragment their liquidity across several blockchains which usually equates to less capital efficiency and higher fees. Across’ main liquidity pool is the $ETH pool which currently earns more than 7% APY and has a utilization ratio of greater than 88%:

What’s crazier is that the 7% doesn’t even include the potential extra 5% APY one can earn if they decide to lengthen the stake of their ETH-LP. This means Across liquidity providers can earn nearly twice the amount in #realyield than compared to what most earn from staking on Ethereum validators:

https://www.compassft.com/indice/styeth/

https://www.compassft.com/indice/styeth/

Security by hUMAns

Across is still the only bridging protocol (so far) that’s been using UMA Protocol’s revolutionary governance tool, which promotes Across DAO’s security by ensuring that their governance data is being validated, and more importantly that their governance data is being validated correctly.

How does it work? When a member of Across submits a new proposal, members are able to vote off-chain and consequently have the results of their votes executed on-chain. Here’s a few of the big advantages of how oSnap secures not only Across, but any protocol that implements the oSnap governance tool:

?oSnap allows for gasless voting, which encourages greater voter turnout as well as increased decentralization.

?oSnap removes the need of a multi-sig to execute transactions, which means that there is less room for a single-source points of failure.

?oSnap increases Across’ overall efficiency as proposals can be executed on-chain without needing to wait on centralized teams in order to do so.

Other Considerations

Wen other L2s? — Perhaps one of my greatest gripes with Across is that they simply don’t have the option (yet) to bridge to more L2s. Personally I’m really hoping that they at some point incorporate , but it’d also be nice to see others including Scroll, Manta, etc…

— By far, the Across Rangers are perhaps one of the most tight-knit yet at the same time, one of the most inviting crowds out there in the crypto space. Not only is it clear that their devs are usually always busy building, but they also have a ton of community weekly events, from everything including poker, bakeoff competitions, and even haikus! Here’s mine:

What’s in store for 2024? — Speaking of building, the Across team has been teasing out that some big developments are underway, and that something will be announced soon:

Curious to find out what it might be? Come see if some of the rangers might drop some alpha during next Thursday’s Valentine’s Day on their call at 5pm UTC.

Given the parabolic increase in activity that we’ve seen on Across so far this year, I’m pretty confident that Across will truly have a banner year in 2024. Week after week it seems that new integrations with other protocols keep rolling out, and it remains one of my go-to places to check first whenever I’m considering bridging on an L2.

Haven’t tried out Across yet? Consider supporting this blog and using my referral link if you do! And as always, thanks for taking the time to read this and be sure to follow me on twitter (https://twitter.com/CryptosWith) to get all my latest updates. Also, looking for a gift for your Crypto-loving/hating friend? Give them a REKT journal to cheer them up!

Disclaimer: This is not financial advice and this is for educational and entertainment purposes only. Please as always, do your own research and find what investments are best for you. Cheers everyone!