Ethereum () competitor Avalance () witnessed an uptick in on-chain activity in the second quarter of 2023, according to the crypto data firm Nansen.

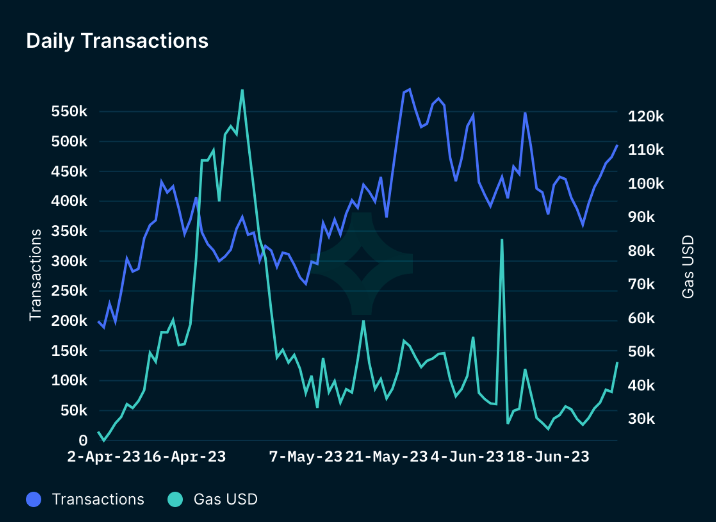

Avalanche’s C-Chain, the project’s default smart contract blockchain, saw between 200,000-550,000 daily transactions throughout the second quarter.

According to the analytics firm, the figures represent nearly double the volume of daily transactions in Q1.

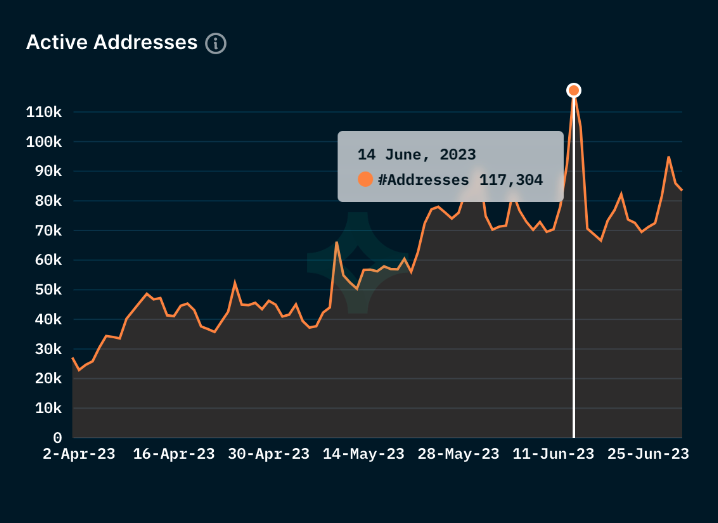

The data firm also that Avalanche’s daily active address count steadily increased across Q2, hitting a high of 117,304 on June 14th.

Nansen,

“The steady increase of active addresses, coupled with the rise in daily transactions, is indicative of healthy growth within the ecosystem and showcases the flourishing community supporting Avalanche.”

Q2’s surge in on-chain activity wasn’t reflected in AVAX’s price, however. The 19th-ranked crypto asset by market cap dropped from trading around $17.79 at the beginning of the quarter in April to $13.02 at the end of June, a decrease of nearly 27%.

Avalanche’s native token is trading at $12.40 at time of writing.

Decentralized finance tracker DeFi Llama also that Avalanche’s total value locked (TVL) dropped from $867 million on April 1st to $693.94 million on June 30th, a decrease of nearly 20%. The platform’s TVL sits at $608.82 million at time of writing.

The TVL of a blockchain represents the total capital held within its smart contracts. TVL is calculated by multiplying the amount of collateral locked into the network by the current value of the assets.