I feel:

“ The freedom to trade on the decentralized network will give a really powerful tools into the hands of humanity to set them free from the failing & ailing financial system, which has devalued our fiat currency so much so that it has lost the charm of being a currency itself.”

DEX is one of the most discussed topics in the crypto world especially among crypto enthusiasts and investors who want to be well informed before embracing this revolutionary blockchain-enabled technology. So I thought to simplify it all for you awesome readers and will be covering everything from

- What Is DEX?

- Why DEX?

- How DEX Works?

- DEX underlying technology

- DEX Examples & Use Cases

So for a Kickstarter let me summarize Decentralized Exchange in few bullet points

DEX SnapShot:

- Unlike Centralized Crypto Exchange DEX’s allow trading without an intermediary

- There is no other custodian to user coins other than the user itself.

- The user has the entire obligation for doing any transaction with DEX.

Now that you understand some core feature associated with Decentralized Exchange let’s jump into its definition and why it came into existence

What Is DEX & How It Differs From Normal Centralized Crypto Exchanges?

If you have been a crypto investor or trader then you may be familiar with popular Crypto exchanges like

- Coinbase

- Binance

- WazirX

- Kraken, etc.

These are the centralized exchanges where you have to first

- Create your user profile

- Complete your KYC

- Deposit fiat currency or any existing crypto

Then you will be in a position to start trading over those exchanges keeping all your digital assets under the concerned exchange custody. Yes it can be a kind of tedious process(But it is mandatory to ensure security and compliances ), But when it comes to Decentralized exchanges you are not required to go through this sign-up hassle

Why No Sign-Up Hussle?

“Its a transaction between two pre-existing crypto wallet ”

When it comes to transacting on dex, two users willing to transact can directly trade with their existing user wallets, not third-part mediation is required. If the user wants to swap any of his currency with another one, the user just needs to connect his/her existing wallet & trade any of his/her digital assets.

With all the above knowledge It’s time to define dex.

“Decentralized exchanges (DEX) are a type of crypto exchange which allows for direct peer-to-peer cryptocurrency transactions to take place online securely between 2 exixting user wallets, without the need for an intermediary.

Unlike centralized crypto exchanges, Decentralized exchanges take a very different approach to buy and sell digital assets: They operate without an intermediary organization for clearing transactions, relying instead on self-executing smart contracts to facilitate trading. This dynamic enables instantaneous trades, often at a lower cost than on centralized crypto exchanges.

DEX Evolution:

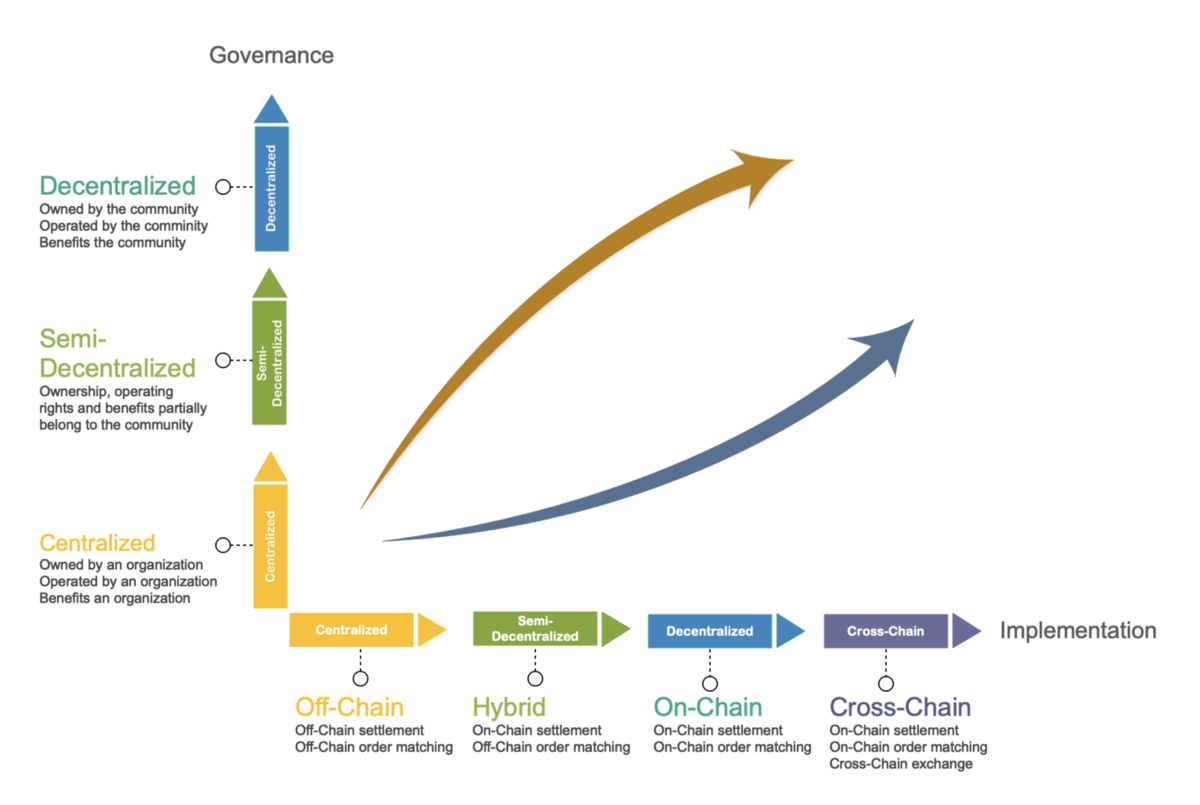

Before we delve into how does DEXs work let’s look into how DEXs evolved through this awesome diagram, which shows how decentralization also evolved after it started with the same fabric of centralized governance and its underlying tech, like CEXs , and eventually evolved into a decentralized world of tech.

DEX evolution, Source

DEX evolution, Source

How Does Dex Works?

The decentralized exchanges use the power of smart contract which is an automatically executed protocol to enable trading between two user wallets without being a custodian of their digital assets. In order to achieve the trade Decentralized exchange utilizes these three mechanisms:

- On-Chain order book

- Off-chain order book

- Automated market maker(AMM)

Let’s cover each of these in some detail

1. On-Chain order book:

Well, the kind of order being employed may vary and depends on DEX’s type. Some Dex’s rely completely on the “On-Chain” mechanism where every order type is written to the blockchain making all the transactions transparent, a truly decentralized approach. This kind of order management completely eliminates the role of a third party whatsoever thereby completely obfuscating the said transactions.

Having said that it comes with a lot of technical and performance glitches and gives a cumbersome, user experience and is not scalable. Also if every transaction needs to be recorded on the blockchain node it may lead to a higher GAS fee.

Front-Running Issue:

On-Chain order has one prominent issue where the insider in the blockchain network is aware of the pending order which has not been executed yet which can be some kind of illegal issue. This kind of problem is known as the front-running problem, though data being in a global public LEDGER does establish some kind of trust.

Example of Exchanges Using the on-chain model:

- Stellar

- Bitshares DEXs.

2. Off-Chain order book:

This order book is largely more centralized as compared to the on-chain approach. With off-chain order books, all of the order is hosted elsewhere in some third-party hosting solutions like Relayer (in the case of Ox protocol) with only the final transaction being settled on the blockchain.

In this a centralized entity can be in complete charge of your order, which increases the risk of it, tampering or influencing the market, via the risk of front-running, etc, but since your coins custody is not in their hand you still are safe to some extent.

The 0x protocol for ERC-20 and other tokens deployed on the Ethereum blockchain is a good example of this.

More Performant :

Off-chain order books are more performant in terms of usability in comparison to on-chain order books. The speed of transaction is much better as we don't need to hit the node always to post the data on the blockchain.

But still, this mode is slightly less efficient as compared to centralized exchanges in terms of order execution because trade still needs to be settled on the chain.

Off-chain transactions usually don’t have a transaction fee, as nothing occurs on the blockchain. Since no miner or participant is required to validate the transaction, there is no fee, making it an attractive option for especially if large amounts are involved.

Off-Chain Examples :

- Binance DEX

- EtherDelta

- Ox Protocol

3. Automated Market Makers (AMM):

On AMM-based decentralized exchanges, the traditional order book is replaced by liquidity pools that are pre-funded on-chain for both assets of the trading pair. The liquidity is provided by other users who also earn passive income on their deposit through trading fees based on the percentage of the liquidity pool that they stake in.

This order management model came into the limelight in 2020 and has picked up as one of the most popular models to do transactions over Dex’s. Decentralized finance largely has leveraged this AMM a lot recently, to change the dynamics of fintech and banking innovations.

So what makes AMM stand out: Well AMMs do not rely on order books they instead utilized the power of smart contracts to create a liquidity pool against the said trades, which gets executed automatically based on set rules or parameters. AMM incentivizes the user to ensure user their participation

Uniswap one such example of AMM is an Ethereum-based decentralized exchange that allows its users to both supply liquidity to earn passive income or exchange between various assets.

Examples Of AMM’s:

- Uniswap: decentralized trading protocol

- SushiSwap

- Curve

- QiSwap by Qtum

- Kyber Network

Now that we have covered all three modes of transaction which is utilized in DEXs, it’s time to summarize this piece by looking into some of the advantages and disadvantages of DEXs.

Pros & Cons Of Decentralized Exchanges:

Though in the journey so far we have already covered some of the key pros & cons associated with DEX, its time to reiterate and give some more attention to this

Advantages:

- No Sign-Up Hussle & No KYC required:

To start using Decentralized exchange you are not required to go through the painstaking user registration and KYC(know you customer) processes. Which you have to comply with if you want to engage in crypto trading on centralized exchanges like Binance, CoinBase, Kraken, etc. So why No KYC, well, as DEXs are permissionless, no one checks your identity. All you need is a cryptocurrency wallet.

- Trading for unlisted token :

There can be a scenario that some of you favorite crypto token may not be available to trade on any centralized exchange no worries, you can trade them over DEX’s given that there are enough demand and supply for the tokens in consideration

- More trust & security :

Centralized exchanges like CoinCheck, Bitfinex in the past have been the victim of security breaches and hacking, which is one of the largest threat which looms large if you are trading on centralized exchanges.

The Coincheck theft alone resulted in a loss of $530 million worth of cryptocurrencies, breaking the previous record of Mt. Gox of $472 million.

It is this concern that is largely addressed by permissionless decentralized exchanges, though they also come with their own challenges but still more reliable as you(user) remain the custodian of their own digital asset.

Disadvantages :

- Not so user-friendly experience wise

“With great things come greater responsibilities”

Users can get lost in the process of using the DEX platform and need to spend more time adapting to their interfaces and processes, especially when it comes to trade with the non-custodial mechanism. For newbies, unlike centralized exchanges where you can still have some chance to get back your lost data, account, but if some mess happens while transacting on DEX, your assets can be lost forever.

For Example: If you forget your password, on Centralized exchanges, you can reset it, but if you lose your seed phrase, your funds are irretrievably lost in the network

So it is recommended that you do your homework right on how to use those platforms, read their decoumensrt and do the. mock run before engaging in some big transactions

- Still New in the crypto space with less trading volume :

DEX’s are still evolving and not many people are transacting when it comes to masses. The volume traded on DEXs are still minuscule compared to that of CEXs. The amount of crypto liquidity is quite large on CEXs as compared DEXs, which is more congenial for buying & trading. Liquidity decides the game as in an illiquid market, you’ll have not much taker to trade your assets that too on a reasonable price tag.

You may not be able to discover the trading pairs your liking more often, and if you do, assets might not trade at the desired price.

- GAS Fee/Transaction Fee

Generally transacting on DEX is cheaper but if the DEX you are using is making use of an on-chain order book your fee can be on a higher side, so do your own research on the exchange you are using.

Signing Off With this Message:

“The real growth of decentralization tech lies in the hands of a real user. If the user in this ecosystem are willing enough to harness it's true potential, with the required sense of accountability and honesty, DEXs will thrive with time and will be a game-changer for sure ”

Thanks a lot for reading this far and supporting me in my desire to be a contributor in your life with all my limitations and capacity.

NOTE!

This article was first published on Medium :

https://medium.com/crypto-wisdom/dex-decentralized-exchange-simplified-61ff0fc640dd

225

225