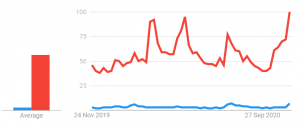

The interest in the term 'XRP' has reached its highest point in more than two years, as the price of the third-biggest cryptoasset by market capitalization has more than doubled in a week.

According to Google Trends, the interest in this Ripple-affiliated project is now highest it has been since the late September 2018. The only time it was higher than the level seen in 2018, was during the December 2017-January 2018 peak.

Interest in XRP in the past 12 months:

We can also compare this to the interest expressed in bitcoin (BTC), which stands as a giant (the red line) over XRP (the blue line) according to the chart below. BTC also saw its peak during the January 2018 frenzy, spiking again in mid-October, and reaching the current level that it previously saw in late June 2019.

And as the XRP price was rising to its highest point since May 2018 (USD 0.765), crypto analytics firm Santiment noted that "the amount of unique addresses transacting on the XRP network in a single day (24,408) was the highest output since May 1st."

Furthermore, XRP rose to the position of the second most popular page on CoinGecko.

XRP is the second most popular page on CoinGecko right now after our home page. Gosh, whyyyyyy. Up 50% in the last 24 hours and everyone is piling in now... pic.twitter.com/X69mJjOsz9

— Bobby Ong (@bobbyong) November 24, 2020

Then, a twist. XRP saw a swift crash, hurting those who bought the top.

$XRP top buyers on COINBASE down 30% in 15mins. pic.twitter.com/97mohlaBT3

— Hsaka (@HsakaTrades) November 24, 2020

That said, it followed that with a quick comeback, currently (14:55 UTC) trading at USD 0.667, after seeing a 23% rise in a day, 121% rise in a week, and 168% in a month. It's still lower than the USD 0.766 it reached today.

But it's not really clear what has been driving this demand in the first place, as is the case with many other rallying altcoins also.

Among recent events, Ripple announced their partnership with the UK-based financial services company MoneyNetint. Additionally, Ripple Labs filed a trademark with the United States Patent and Trademark Office earlier this month, for a new product dubbed Paystring - "intended to cover the categories of electronic financial services, namely, monetary services for receiving and disbursing remittances and monetary gifts in fiat currencies and virtual currencies over a computer network and for exchanging fiat currencies and virtual currencies over a computer network," as the filling said.

Ripple could also have benefited from the success of their partners.

Congrats on a very strong quarter! Proud to be a partner in MGI's digital growth transformation. There’s no doubting the network’s growth and benefits for consumers. https://t.co/SPvNx05duk

— Brad Garlinghouse (@bgarlinghouse) October 30, 2020

Furthermore, another event is nearing - the planned December 12 airdop of 45bn governance Spark tokens to XRP holders of non-custodial wallets by blockchain platform Flare Network, which is backed by Ripple's investment arm Xpring, rebranded to RippleX. Per Flare, 28 exchanges currently support the airdrop.

Also, as reported today, Ripple has posted a job advertisement as it looks to recruit a Senior Director for Central Bank Engagements – the clearest indication yet that the company is planning to increase its focus on central bank digital currency-related initiatives on the XRP LEDGER in the near future.

Meanwhile, others argue that people buy XRP because they can't afford BTC.

It’s the Oh-man-bitcoin-is-so-expensive-but-hey-that-XRP-sure-looks-cheap-I-have-no-idea-what-it-is-but-I’ll-buy-some-of-that pump

— ?rooke (@bitcoinmom) November 24, 2020

____

More reactions:

US FED really just used you guys as exit liquidity pic.twitter.com/BKi9ygvkW7

— red (@redxbt) November 24, 2020

__

Trust me when I tell you that I absolutely hate $XRP and it belongs in the trash.

But the market doesn't care about my feelings. My feelings don't make money either.

Oh my god, I take back everything I've ever said about Ripple. Brad Chaddinghouse was always my friend.

— Loma (@LomahCrypto) November 24, 2020

__

biggest xrp liquidation i could find. 74k notional.

not much in the scale of things but imagine explaining that loss to someone.... lol

"you lost a car on which shit coin?" https://t.co/dkyuedrWVI

— i.am.nomad (@IamNomad) November 24, 2020

__

Look I get it, you can trade $XRP and make money, congratulations. I’m sure there is also money to be made in like liquefying orphans as fuel for street lamps or something, but you have to have a line you are not willing to cross.

— kain.eth (@kaiynne) November 24, 2020