Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

Cryptocurrency investors typically trade on multiple venues, whether pure digital asset platforms, fiat-to-crypto exchanges, or any other variations. Among many benefits, this allows them to compare prices between different markets across several trading platforms for arbitrage profits.

Prices of major cryptocurrencies, altcoins, and illiquid tokens jump up and down multiple times a day. Thus, an aggregated platform would enable users to take advantage of market opportunities that most would otherwise be overlooked.

That said, having multiple cryptocurrency trading accounts raises many challenges such as tracking your portfolio or executing trades on multiple exchanges simultaneously.

As per recent industry data, there are in total 365 online cryptocurrency exchanges listed on Coinmarketcap. But that’s just a selected list on the major crypto data aggregator. In fact, there are many other digital asset trading platforms, and the number is only growing due to the incredible popularity of cryptocurrency investments.

In practice, however, trading on multiple cryptocurrency exchanges is truly complex. Some of the reasons for this are as follows:

- Every time you want to trade on a particular exchange, you have to log in with your own account credentials and go through all security measures in place, such as 2-factor authentication.

- It's a hassle to track the pricing of the assets you trade across several exchanges, analyze your portfolio performance, or compare price discrepancies to spot arbitrage opportunities. This is even more difficult when you trade different digital assets.

- Also, keep in mind that you have to act so fast in order to capitalize on the differing prices for the same asset across disparate platforms. Price discrepancies exist for a very short duration, so such trades should be executed with a minimal delay to exploit the flashing opportunity. The risk of failures or technical errors has to be minimized as well.

- As crypto exchanges have come a long way, you have to get yourself accustomed to different user interfaces, fee structures, dashboards, contract specifications, etc.

- You need to have deposits on all exchanges you trade on with many financial and technical complexities involved here.

Crypto exchange aggregators

On top of all hurdles mentioned above, dealing with the evolving regulatory environment across different jurisdictions is very complex.

That is why many startups have come up with the idea of a unified platform that provides crypto traders with consolidated services to tackle challenges in regard to user experience.

The idea is simple, basic. It would be easy if crypto investors could perform all trading operations on just one single interface, without switching here and there.

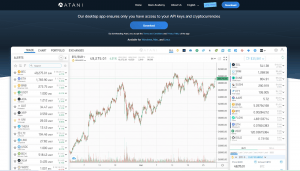

An example of one of these promising startups is Atani, who offers a comprehensive crypto ecosystem that allows users to manage multiple accounts across 22 crypto exchanges into one interface.

Atani’s API connection to cryptocurrency exchanges allows users to continue trading at these venues even when the original exchange’s platform is down. This provides a further layer of protection for Atani users and allows them to navigate and benefit from market pumps & dumps.

Atani also bundles together many features that crypto investors need, like real-time alerts, TradingView charting, technical analysis tools, advanced order types, and a trading calculator. These trading tools are available for free on Atani’s apps for Windows, Mac OS, and Linux devices.

Things have evolved further with many of these ‘all-in-one’ projects now offering an inclusive package, from access to multiple exchanges, a wide range of useful tools, user-friendly trading experience to built-in tax auditing reports. Portfolio tracking, asset discovery, price, and liquidity analysis, even scalping trading were also made easy under a single application.