American financial advisors are growing increasingly crypto-keen, with a survey of almost 1,000 professionals in December showing that no advisors were looking to offload crypto holdings over the year ahead.

The findings were compiled in a report about financial advisers and their crypto-related options published by the San Francisco-based asset management firm Bitwise.

The firm said that it spoke to just short of 1,000 financial advisors based in the United States in December last year, with 78% (up from 42% in the previous survey) answering that they intended to “increase their clients’ allocation” of crypto in the next 12 months, with 22% “intending to hold steady.” Significantly, the company reported, “no advisor with client positions today reported plans to decrease or eliminate their position.”

Moreover, 17% of advisors who are not currently allocating to crypto in client portfolios said they will either “definitely” (2%) or “probably” (15%) allocate in the next 12 months. That is more than double the number who reported plans to allocate in the 2020 survey, the authors said, adding that 82% of advisors reporting client allocations to crypto also reported a personal investment in the space.

The data also showed that the number of advisors allocating to crypto in their client portfolios rose to 9.4%, up 49% from 2019.

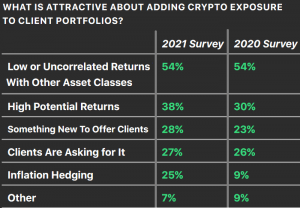

And it seems that, among the reasons to invest in crypto, inflation hedging saw the biggest jump.

Also, while volatility and regulatory worries were once factors that kept financial advisors at an arm’s length from crypto, it appears that some are now less concerned by these once prohibitive concerns.

Last year’s survey found that 56% of advisors were held back from advising their clients to invest in crypto due to regulatory concerns – a figure that actually fell to 54%.

And while volatility was a concern for 43% of advisors last year, only 39% stated that they found it off-putting in the latest study. Fewer advisors (12%, down from 20%) now associate crypto with criminal activities.

However, there was a rise of 5% in the number of respondents stating that a lack of understanding of how crypto works was stopping them from speaking to their clients about token-based investment.

Regardless, more than half of respondents said that “better regulation” would lead them further into the world of crypto, with 47% (up from 37% in the previous survey) hoping that a bitcoin (BTC) exchange-traded fund (ETF) would launch to give the sector more legitimacy in the financial community. Moreover, ETFs were once again named as the top choice (64%) for investing in crypto. Direct owerniship of cryptoassets by 16% of respondets, the same as in the previous survey.

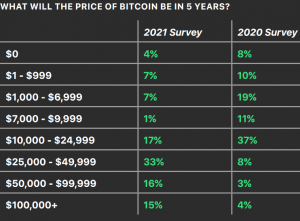

And this is what advisers expect when it comes to the price of bitcoin:

At the time of writing (10:49 UTC), BTC trades at USD 34,634 and is down by over 1% in a day and is unchanged in a week. The price rallied by 81% in a month and 307% in a year.

__

Learn more:

Ruffer Reveals Why They Poured GBP 550M in 'Non-Sensical' 'Beast' Bitcoin

Crypto Traders Smell Institutional-Grade Bitcoin Price Manipulation

Current 'Trickle Into Bitcoin' Could Become 'A Torrent' - Bill Miller

Crypto in 2021: Bitcoin To Ride The Same Wave Of Macroeconomic Problems

Two Reasons Why Bitcoin Differs From Google, Amazon, & Facebook Networks