US-based major crypto investment company Grayscale said it once again "experienced unprecedented investor demand" in the last quarter of 2020. (Updated at 16:59 UTC: updates throughout the entire text).

The company said it raised USD 3.3bn in 4Q20, bringing YE20 inflows to USD 5.7bn. In comparison, in 2019, the company raised USD 600m in total. Last year, Grayscale institutional capital represented 93% of the total inflow.

Also, in 4Q20, inflows to Grayscale Bitcoin Trust were a record USD 2.8bn. This brought YE20 Grayscale Bitcoin Trust inflows to USD 4.7bn, over four times the cumulative inflows of the previous six years, the company said.

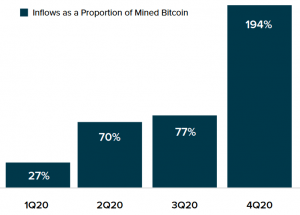

"As we have noted in prior reports, the inflows into Grayscale Bitcoin Trust have continued to grow as a percent of mined bitcoin. This metric is significant because miners are known to be the market’s natural sellers, often using their newly mined bitcoin to pay for operating expenses. In 4Q20, Bitcoin inflows were approximately 194% of mined bitcoin," they added, clarifying that these comparisons are simply to illustrate supply and demand in the market. Miners now generate around BTC 900 per day.

The company claims that now it owns 3.31% of the circulating supply of BTC, compared with 1.45% a year ago. Meanwhile, ethereum (ETH) holdings increased from 0.1% to 1.33% of the circulating supply.

Also, they added that, in 4Q20, demand for Grayscale products excluding Grayscale Bitcoin Trust grew to USD 436.4m, up 35% QoQ, and up nearly 1,300% from 4Q19. Much of the increase was driven by continued inflows into Grayscale Ethereum Trust (USD 341.8m).

Grayscale 2021 outlook:

- "In 2020 we saw institutions adding Bitcoin to their balance sheets - in 2021 we may see nation-states follow suit."

- "More investors and advisors alike will be considering how to best fit this asset class within a larger portfolio."

- "Bitcoin rewards could become a significant source of demand for Bitcoin." "We expect major credit card companies could follow suit as they see the success of these Bitcoin products."

- "Bitcoin mining is helping to subsidize underutilized energy infrastructure and may be integrated into public green energy initiatives."

- "As the search for yield intensifies in traditional markets, we expect major financial firms to consider integrating with decentralized protocols."

- "in 2021 we may see the beginning of digital currencies integrating into national banking infrastructures."

As reported, this week, Grayscale Investments said that most of their private placements are now open for daily subscription again after they were temporarily closed at the end of 2020.

After a break since the 24th of December, @Grayscale ’s bitcoin trust is as of yesterday open to new investment.

— GBTC Bitcoin Tracker (@GbtcT)

At the time of writing (16:57 UTC), BTC trades at USD 39,310, correcting lower from USD 40,000, briefly touched today. The price is still up by 13% in a day and is unchanged in a week. It more than doubled in a month and rallied by over 351% in a year.

___

Learn more:

Crypto Traders Smell Institutional-Grade Bitcoin Price Manipulation

'Possible Limitations' For Buyers as BTC Searches Skyrocket, Shoeshine Indicator 'Irrelevant'

___

Find more insights about the crypto trends in our special series Crypto 2021.