SEC Fines Bitcoin Crypto Wallet

July 13, 2020 2:38 pm

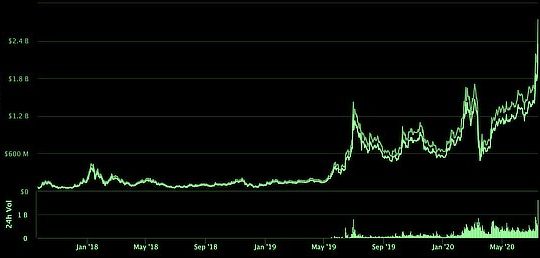

That a dapp on ethereum would be bitcoin’s scaling solution is something few thought during the great scaling debate, but the market has spoken.

MakerDAO’s dai producing dapp currently holds about 5,000 bitcoins, worth about $45 million.

Bitcoin’s own Lightning Network (LN) instead, despite it being hailed as the solution to solve all of bitcoin’s problems, has only 1,000 bitcoins which are worth circa $9 million.

Even Aave, launched only a few weeks ago, has more bitcoin than the Lightning Network.

As does Curve, which is even newer, with both having just over 1,000 btc, while LN took more than two years to get to that 1,000 bitcoin line.

As you might know, amid significant debate on how to accommodate more bitcoin users with initially the preferred choice being to just increase the blocksize, Blockstream devs argued there was no need as all transactions could happen on this amazing second layer network called LN.

When we gave it a testrun after they began a passing the torch campaign, it quickly became clear the Lightning Network was unusable from an end-user’s perspective.

It is fairly typical actually of bitcoin ‘dapps’ to be quite clunky, presumably due to its very limited programmable capabilities.

While one of the first positive impression one gets from eth is just how convenient using their dapps is, with the dai pegged dollar production, for example, now being just as easy as one click on Oasis.

Same goes for Compound and other ethereum dapps. And more importantly, because they have a Turing complete programmable language these dapps can scale in a way the user wouldn’t even notice, except obviously they’d have a far better experience.

That’s because unlike Blockstream’s choice for bitcoin scaling, LN which needs a user action to lock bitcoin in it with added security risks, for ethereum dapps you can kind of code something similar but better than LN within the dapp itself.

So you can tell the dapp for example if the user is performing a function within the dapp or is sending funds to another dapp user, then keep accounts within the dapp and send them to the blockchain only when the user wants to exit the dapp.

You do that through zk tech and Plasma and all sort of stuff, but the main point is the user wouldn’t even know you’ve added this boosting if they’re new to dapps.

Current users would obviously notice the change and everyone would notice the difference between a boosted dapp and one that isn’t, but the change is at the backend, while in bitcoin it is at the front end as for LN scaling you’re using a completely different system.

That means ethereum can scale and it can scale now through these contract methods. Bitcoin can’t scale and there aren’t any plans to change that significantly even in the medium term, let alone in the near term.

Thus that ethereum is finding much adoption even among bitcoiners that have been its chief critic, is perhaps not surprising.

Not least because ethereans now don’t even need to leave their own blockchain to get bitcoin usable on their own dapps with the eth convenience and with the serious efforts of ethereum developers to scale the network to a global capacity level.

Comments

July 13, 2020 2:38 pm

July 13, 2020 2:12 pm

July 13, 2020 12:03 pm

Ждем новостей

Нет новых страниц